Meet three CPAs on paths that point the way to the future

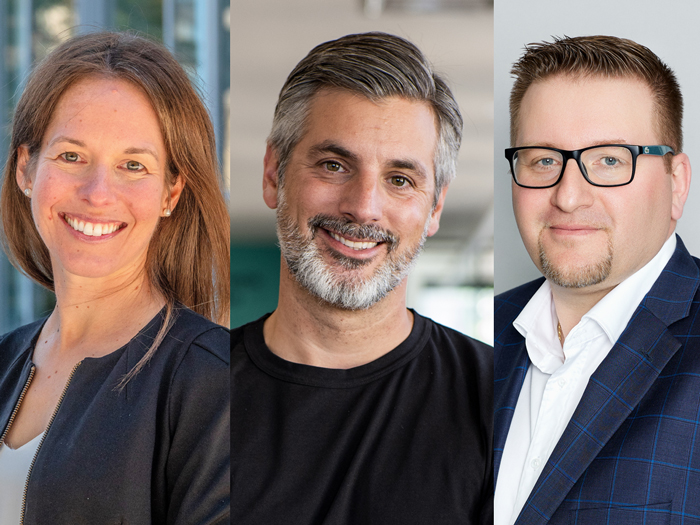

Caroline Gadbois, Vincent Godcharles and Kevin Kolliniatis (Images provided)

Caroline Gadbois, Vincent Godcharles and Kevin Kolliniatis (Images provided)

In a world shaped by technological disruption, ESG concerns and AI-induced change, it stands to reason that our organizational processes are shifting as well.

Here we have brought together three CPAs who are already working in radically forward-looking ways. While their jobs are not necessarily futuristic or highly specialized, they are all helping to forge new practices that will lead the way to the future.

These CPAs all recognize that their CPA training has helped them over the course of their careers, and there is no doubt that they, too, will inspire other CPAs to chart their own course.

Sustainability at heart: Caroline Gadbois

Director, ESG Reporting and Assurance at PwC Canada

Ever since she was a young girl growing up on her parents’ vegetable farm, Caroline Gadbois has had a strong affinity with nature. “Sustainability is one of my values, and I’ve been particularly interested in it since university.” Now, with more than 14 years’ experience in providing auditing services at PwC, Gadbois didn’t hesitate when the firm offered her the opportunity to head the ESG department in the Montreal office in 2021. “In just two years, my team has grown from five to 15 people, and we expect to double in size every year due to the volume of requests anticipated with the introduction of new standards.”

In fact, with the International Sustainability Standards Board having released it’s first two sustainability standards this past June, many Canadian companies looking to become leaders in sustainability plan to start publishing compliant ESG reports as early as next year. “If the Canadian Securities Administrators decide to adopt the climate-related disclosure requirements, these standards could come into force as early as January 1, 2024. So time is of the essence, especially as concurrent rules, such as the Corporate Sustainability Reporting Directive, are already in place in Europe for some organizations operating there.”

While the need to comply with the new standards is a given for large organizations, medium-sized businesses will have to follow suit if they want to fulfill their stakeholders’ needs, Gadbois says. “For example, more and more tenders include requests for ESG information. Investors and financial institutions are also asking for this type of information, which in certain cases can help businesses obtain better financing rates. Smaller businesses acting as suppliers will also be affected.”

The good news is that there are many young people ready to help clients adopt ESG standards.

“Many of my employees are CPAs who have completed a program, certificate or master’s degree in sustainability through a university or CPA Canada. Others are simply passionate about the subject. Either way, their CPA training prepares them very well to work in this field. Actually, auditing greenhouse gas emissions is not that different from auditing sales figures. The subject matter is different, but CPAs have no trouble understanding business models, assertions or potential risks. And when it comes to more technical aspects, such as understanding the sources of emissions, they can call on experts for help.”

Moreover, Gadbois adds, ESG disclosure is a relatively new area, so few people can claim to have been working in it for a long time. “It really is a field of the future, and there’s never been a better time to get involved.”

Corporate efficiency expert: Vincent Godcharles

CEO of Logient and nventive, partner at Oliva Capital

Heading an army of several hundred tech experts, Vincent Godcharles is propelling today’s companies into tomorrow’s world.

After spending the early part of his career in an accounting services firm and marketing agencies, Godcharles turned his attention to IT, becoming CEO of Logient in 2014 and of nventive in 2023. Both companies are part of Oliva Tech, a division of Oliva Capital, an investment firm in which he also became a partner in 2021.

“While nventive focuses primarily on the digital user experience, Logient concentrates on increasing organizations’ efficiency through digital transformation,” says Godcharles.in. “Among other things, we develop customized management systems and integration of ERP or CRM platforms such as SAP, Dynamics or Salesforce . We build clean databases and even data lakes that store up to hundreds of millions of data lines. We can then automate business processes and use powerful algorithms to improve efficiency.”

Godcharles is quick to admit that he’s not an IT expert by any means. “I’m surrounded by nearly 550 specialists in the field, about 400 at Logient and 150 at nventive. On the other hand, I do know how to explain to a CFO or executive why they need to focus on the unique experience their organization needs to deliver, how automation can make their organization much more efficient, and how everything to do with security is important.”

Godcharles knows that digital transformation is daunting for many organizations; however, customized solutions can easily be deployed at low cost in smaller organizations.

“That’s where my CPA experience comes in,” he says. “CPA training touches on everything: accounting and finance, of course, but taxation, human resources, technology, marketing and more. It makes me a better leader and gives me an edge when I’m working alongside colleagues who don’t have a background in these areas.”

Godcharles also points out that his experience working with various organizations in his early days gives him a better sense of the issues facing those he works with today. “Some people worry about the cost of transformation, but technology doesn’t stand still, so the longer they wait, the more their technology debt increases. As a CPA, I’m able to explain to them why this is an investment and not an expense, as well as the potential return. Whether or not they understand this can be a matter of life and death for their organization.”

The next-gen auditor: Kevin Kolliniatis

Partner and National Technology Leader, Audit and Assurance, KPMG Canada

As national technology leader with KPMG in Canada’s audit and assurance practice, Kevin Kolliniatis is playing a pivotal role in the shift toward continuous auditing at KPMG Canada.

“I have been in the audit and assurance field for more than 24 years, and especially in the past few years I’ve been looking at the profound impact that continuous auditing will have on the accounting profession,” says Kolliniatis. “I see it as the dawn of a brand-new era in auditing.”

Unlike traditional auditing methods, which rely on point-in-time procedures, continuous auditing is characterized by a continuous flow of client information that is analyzed, monitored and flagged for exceptions in real time. “You basically have a pipeline that feeds information from your core client system to a system that you”re applying continuous analytics. If an outlieris identified, you or your client can react immediately,” says Kolliniatis.

In addition to allowing for real-time transaction monitoring by management, continuous auditing can also help detect issues such as double billing. And unlike traditional auditing techniques, which are based on sampling, it covers 100 per cent of transactions.

Despite the obvious advantages of continuous auditing, however, it’s only recently that it’s been possible to start bringing together the elements needed to enable it. “Having the right technology is one aspect, but people need to adapt as well,” Kolliniatis says.

To help in that process, Kolliniatis and his team started working with Simon Fraser University six years ago to build a program where KPMG professionals could obtain a Graduate Certificate in Accounting with Digital Analytics, then move on to a Master of Science in Accounting with Cognitive Analytics. “That was an important stepping stone because we needed to get our workforce to a certain level to apply the concept.”

The firm also realized that they needed a certain number of people who understood data science, computer science, data and databases. “We hired several staff with those skills early on because they are instrumental in making the system work,” he says.

Beyond the firm, clients also needed to be able to manage a continuous auditing process. “With continuous auditing, interactions with the auditor are more frequent throughout the year. But that”s a good thing, because it means by year end the auditor has a good understanding of the business and the transactions that have taken place.”

Naturally, there are still a few obstacles standing in the way of continuous auditing. “The technology isn’t fully there yet—there are literally hundreds of accounting packages on the market,” says Kolliniatis. “Also, a number of clients still haven’t moved to cloud solutions, so that makes the data capturing process more difficult.”

Still, in the past five years Kolliniatis has seen major changes in technology that are starting to provide the foundations for easier adoption. “Inevitably, this is going to be the way of the future,” he says. “In five years, I think we might see 10 per cent, maybe 20 per cent adoption. We’re getting to that spot, for sure. As a CPA, it’s fascinating to be involved in such an important transformation.”

LEARN MORE

Explore CPA Canada’s technology resources on the impact of automation and AI on the role of the CPA. And find out if AI is moving too fast for regulators to keep up.

Also, explore CPA Canada’s resources to discover how organizations focusing on sustainability can successfully balance bottom-line results with other key factors, including impacts on society and the environment.