Canadian tax news and COVID-19 updates archive

DECEMBER 2021

December 22, 2021

Federal government temporarily expands access to Lockdown Program and Worker Lockdown Benefit

On December 22, the federal government announced its intention to temporarily expand eligibility for key support programs to ensure Canadians are protected and workers and businesses get the help they need to sustain them through new and necessary public health restrictions. More details on these measures are included in their backgrounder.

December 21, 2021

Update on Bill C-2

Further to our November 25 update, Bill C-2 received Royal Assent on December 17. Note that the Bill was amended by the House of Commons Standing Committee on Finance with a change that may restrict subsidy claims made by a publicly traded company or a subsidiary of such a company that paid dividends to an individual who held common shares.

December 20, 2021

Update on home office expense deductions and form T2200

The CRA has updated their main home office expense deduction page with the following message:

“For the 2021 and 2022 tax years, employees working from home due to the COVID-19 pandemic may be able to claim up to a maximum of $500 using the temporary flat rate method, to calculate their home office expenses as announced in the Fall Economic Statement by the Government of Canada. Web content and forms are currently being updated to reflect this change.”

As many employers offered flexible working arrangements during 2021 as pandemic restrictions were lifted, we have asked the CRA to provide guidance on how these arrangements will be dealt with as they update their resources.

We will provide updates as more information becomes available.

Update on trust reporting proposals

In the 2018 federal budget, the government announced new reporting requirements that will apply to certain trusts. Under the proposals, affected trusts will be required to report the identity of all trustees, beneficiaries and settlors, as well as the identity of each person who has the ability to exert control over specific trustee decisions. Significant penalties can apply for non-compliance. These proposed rules were scheduled to apply to returns required to be filed for the 2021 and subsequent taxation years. Draft legislation for these proposals was released but has not been passed into law.

We had hoped that more information on this would be released in the recent 2021 Economic and Fiscal Update, but no new information was communicated. We have again asked the CRA to confirm what will be required for 2021 T3 returns.

December 17, 2021

CRA responds to the top questions from CPAs across Canada

This year, CPAs across the country were canvassed to pose the top questions they have for the CRA. We received hundreds of questions which we were able to streamline into 29 key questions from our members to the CRA. View the responses from the CRA.

CRA updates guidance on transitional administrative relief for the GST/HST digital economy measures

The federal government previously announced that the CRA will work closely with affected businesses and platform operators to assist them in meeting their obligations under the new GST/HST digital economy measures. Where the affected businesses and platform operators show that they have taken reasonable measures but are unable to meet their new obligations for operational reasons, the CRA will take a practical approach to compliance and will exercise discretion in administering these measures during a 12-month transition period, starting July 1, 2021.

In Excise and GST/HST News - No. 110, the CRA now indicates that before the CRA exercises its discretion in the administration of the new measures, an affected business or platform operator must first make a submission to the CRA requesting forbearance and obtain the CRA’s written approval that such discretion will be exercised.

December 16, 2021

Tax highlights of the 2021 Economic and Fiscal Update

On December 14, 2021, the Honourable Chrystia Freeland tabled the federal government's 2021 Economic and Fiscal Update. Read our summary of the key tax measures.

December 7, 2021

CRA resuming CEWS post-payment program audits

In a stakeholder email dated December 7, 2021, the CRA announced it is resuming its Canada Emergency Wage Subsidy (CEWS) post-payment audit program as of Fall 2021.

The purpose of the audits is to identify claim errors and make sure those who received CEWS benefits qualified for them. During the audit process, CRA auditors will contact claimants with a request to submit the documentation needed to verify revenue and payroll. If you and your clients require additional time to gather the requested documentation, you should contact the auditor reviewing the file.

December 6, 2021

Government releases draft legislation on delivering Climate Action Incentive (CAI) payments quarterly

On December 3, the federal government released a backgrounder and draft legislation which will change the delivery of CAI payments from a refundable credit claimed annually on personal income tax returns to quarterly payments made through the benefit system.

Starting with the 2021 taxation year, the CAI would no longer be claimed on personal income tax returns. That said, individuals would still need to file a tax return in order to receive CAI payments for the upcoming fuel charge year and also indicate whether they live outside a Census metropolitan area (and thereby qualify for the rural supplement for the upcoming year).

To give the CRA sufficient time to develop the new system, payments would start in July 2022 with a “double-up” payment. This payment would return proceeds from the first two quarters of the 2022-23 fuel charge year.

December 1, 2021

Update on the completion of T2 Schedule 141

As discussed in our March 2021 tax blog, many members will be engaged to assist clients with their accounting, bookkeeping and tax compliance needs but they may not be performing an audit, review or compilation as part of their work. In these situations, the work performed by the member will have an impact on the client’s accounts that are used by the member to prepare the corporation’s income tax return (the federal T2).

Schedule 141, Part 1 of the form deals with information on the accountant who prepared or reported on the financial statements. Part 2 of the form must be completed unless the accountant does not have a designation or if the accountant is connected with the corporation. The nature of the questions in Part 2 creates uncertainty where a member is assisting the client in preparing their financial records (for example, doing bookkeeping) and preparing a tax return but are not performing an audit, review or compilation on the financial statements.

We have discussed the need to update the form with the CRA and we understand that a new version of the form will likely be released later in 2022. In the meantime, the CRA has confirmed with us that where the member provides bookkeeping and tax preparation services but does not perform an audit, review or compilation, the response to the two questions in Part 1 of the form can be “no,” which will eliminate the requirement to complete Part 2 of the form.

CRA provides guidance to taxpayers facing extreme weather events

The CRA has provided guidance to taxpayers who will not be able to deal with their federal tax obligations due to flooding in British Columbia and Eastern Canada. In its news release, the CRA has provided more information on the Taxpayer Relief Program and provided some suggestions to reduce the disruption caused by the recent catastrophes. In particular, the CRA states that Canadians facing such extraordinary circumstances will be treated fairly if they are unable to meet their federal tax obligations during this time.

We will provide more information if there are further developments.

NOVEMBER 2021

November 29, 2021

Watch now: Webinar on running a high-quality tax practice from The ONE Conference 2021

Tax legislation and administration are increasingly complex, bringing more risk for those who provide tax services to their clients. During the 2021 The ONE Conference, Bruce Ball, vice-president of taxation at CPA Canada, Malcolm D'Souza, executive vice-president at CPA Professional Liability Plan Inc., John F. Oakey, national director of tax services at Baker Tilly, and Sandy Stedman, partner at Schibli Stedman King discussed strategies to run a high-quality tax practice. Watch the video to find out what the most common, current sources of insurance claims filed against tax practitioners are, and learn simple but effective strategies and best practices to mitigate these risks.

You can also learn more about this topic from our September tax blog: Tips on running a high-quality tax practice. Be sure to sign up for our tax blog to join our growing audience of over 25,000 tax professionals who receive updates on the latest tax blogs as well as resources and professional development opportunities.

Reminder: CRA no long collecting Ontario information returns for corporations

As a reminder, the CRA stopped collecting the following Ontario annual information returns as of May 15, 2021:

- T2 Schedule 546 for Ontario business corporations

- T2 Schedule 548 for foreign corporations that carry on business in Ontario

- Form RC232, for Ontario Not-for-Profit Corporations

According to information provided to us, the Ontario government took over responsibility for administering the annual information return required under Ontario law as part of the implementation of their new Ontario Business Registry system.

The Ontario government has revised their website to include new information on the annual return, the steps for filing it, and using the new site more generally. It is worth noting that the Ontario annual information return is due at the same time as the corporation’s T2 income tax return for federal income tax purposes under the regulations to the Ontario Corporations Information Act.

According to the Ontario government website, “from May 15, 2021 through October 18, 2021, corporations whose annual returns were due during that period were exempt, meaning those corporations did not have to file an annual return for 2021.” As it indicates the exemption applies to any return that was due during this period, this should mean that, for example, a return for the fiscal year ended December 31, 2020 qualifies for the exemption. The website goes on to state that “corporations who have an annual return due after October 18, 2021 must file their annual returns, which they can now do directly in the registry.”

For most Ontario corporations, some work will be needed before an annual return can be filed. The steps are outlined on the website. Basically, the person doing the filing (either the business owner or a representative) must be registered (obtain a “ONe-key Account”) and the corporation for which an annual return is needed must obtain a “company key” so that the corporation can be linked to the filer’s ONe-key account. More information and contact details for the Ontario government are included on the website.

November 25, 2021

Government introduces Bill C-2 to implement recently announced changes to COVID-19 business and worker support programs

On November 24, the federal government introduced Bill C-2 to implement the recently announced changes to its COVID-19 business and worker support programs which we summarized in our October 21st post. In addition, the government provided additional guidance on the types of business that would be eligible for the Tourism and Hospitality Recovery Program in its backgrounder.

Under the proposed changes, the Canada Emergency Wage Subsidy (CEWS), the Canada Emergency Rent Subsidy (CERS), and the Canada Recovery Hiring Program will be extended until May 7, 2022. Support under the CEWS and the CERS would be available to the tourism and hospitality sector and to the hardest-hit organizations that face significant revenue declines. Eligible entities under these rules would need to demonstrate a revenue decline over the course of 12 months of the pandemic, as well as a current-month revenue decline.

In addition, organizations subject to a qualifying public health restriction would be eligible for support, if they have one or more locations subject to a public health restriction lasting for at least seven days that requires them to cease some or all of their activities.

The proposed legislation also allows the government to extend the subsidies by regulation but no later than July 2, 2022 and the programs will continue to be administered by the CRA.

The Canada Recovery Benefits Act will also be amended as previously announced.

We will provide more information as it becomes available.

November 22, 2021

Obligations under the new GST/HST rules for digital economy businesses

As reported in our November 15 news item, the CRA has deferred the filing requirement for the first calendar year information return under the new GST/HST rules for digital sales (the new rules) to help affected platform operators adjust to the new reporting requirement.

While the CRA has deferred the filing requirement of the information return for certain platform operators for the 2021 calendar year, we wanted to remind readers that businesses affected by the new rules are still required to register and comply with all other requirements. This includes:

- Registering either a simplified GST/HST account or a normal GST/HST account. The registration requirements are based on the digital economy measure that applies to the business.

- Once registered for the GST/HST, businesses are required to begin charging and collecting the tax on the taxable supplies that you make in Canada, completing and filing the GST/HST return, and remitting the tax collected. There may be different obligations depending on the type of business which the CRA webpages provide further detail on.

Note that storage service providers that fall under the new rules are still required to provide the CRA with notification by January 1, 2022, that they supply the storage services in the course of a business carried on as of July 1, 2021 (or within six months after the day on which the business began supplying the storage services in the course of a business).

November 15, 2021

GST information return for platform operators not required for the 2021 calendar year

Under new GST/HST rules that became effective on July 1, 2021, distribution platform operators in respect of a supply of qualifying goods or an accommodation platform operator in respect of a supply of short-term accommodation situated in Canada are generally required to file an information return for the calendar year.

The CRA has recently updated their GST/HST for digital economy businesses webpages to indicate that they are deferring the filing requirement for the first calendar year information return to help affected businesses and platform operators adjust to the new reporting requirements. Thus, information returns will not be required for the 2021 calendar year. Going forward, the information return reporting requirement will be in effect for all other calendar years. For example, the information return for 2022 must be filed before July 2023. The CRA indicates that procedures for filing the information returns will be issued in advance of the filing deadline.

November 9, 2021

DTC promoters restrictions regulations suspended until further notice

The CRA has recently updated their Q&A webpage on the Disability Tax Credit Promoters Restriction Act (DTCPRA) with the following statement: “Due to a court injunction, the Disability Tax Credit Promoters Restrictions Regulations are suspended until further notice.”

We believe the court case being referred to is True North Disability Services Ltd. v Canada (National Revenue), 2021 BCSC 2142 where the B.C. Supreme Court recently granted an injunction suspending the Government of Canada from implementing the $100 fee restriction on promoters under the DTCPRA until a determination is rendered by the court of the constitutional question raised in the case.

OCTOBER 2021

October 25, 2021

CRA My Business Account (MyBA): Capital Dividend Account (CDA) issues

It has come to our attention that there were some issues with CDA information in MyBA. We have made the CRA aware of these concerns and they are working on resolving them. To avoid confusion, corporate CDA information won’t be available in MyBA until after the issues are resolved. The capital gain and loss summary has also been taken down. The CRA expects to resolve the issues and have this information available again by December. We will keep you posted once we get more information.

October 21, 2021

Federal government proposes changes to business and worker support programs

On October 21, 2021 the federal government announced proposed changes to both business and worker support programs. It was confirmed that the existing general support programs that were scheduled to end on October 23, 2021 will in fact end on schedule. However, more focused assistance will be made available as discussed below.

Changes to business support programs included:

- Extend the Canada Recovery Hiring Program until May 7, 2022, for eligible employers with current revenue losses above 10 per cent and increase the subsidy rate to 50 per cent.

- Since the wage subsidy, rent subsidy and lockdown support will expire on October 23, 2021, the government is introducing two new targeted support programs:

- Tourism and Hospitality Recovery Program, which would provide support through the wage and rent subsidy programs, to hotels, tour operators, travel agencies, and restaurants, with a subsidy rate of up to 75 per cent.

- Hardest-Hit Business Recovery Program, which would provide support through the wage and rent subsidy programs, would support other businesses that have faced deep losses, with a subsidy rate of up to 50 per cent.

Applicants for these programs will use a new “two-key” eligibility system whereby they will need to demonstrate significant revenue losses over the course of 12 months of the pandemic, as well as revenue losses in the current month.

Businesses that face temporary new local lockdowns will be eligible for up to the maximum amount of the wage and rent subsidy programs, during the local lockdown, regardless of losses over the course of the pandemic.

These programs will be available until May 7, 2022, with the proposed subsidy rates available through to March 13, 2022. From March 13, 2022, to May 7, 2022, the subsidy rates will decrease by half.

The government also proposed the following changes to worker support programs:

- Extend the Canada Recovery Caregiving Benefit and the Canada Recovery Sickness Benefit until May 7, 2022 and increase the maximum duration of benefits by 2 weeks.

- Introduce the Canada Worker Lockdown Benefit which would provide $300 a week in income support to eligible workers should they be unable to work due to a local lockdown anytime between October 24, 2021 and May 7, 2022.

We will provide more information as it becomes available. Backgrounders are also available on the targeted business support programs and the new Canada Worker Lockdown Benefit on the Department of Finance site.

October 14, 2021

Update to Represent a Client authorization verification process

The CRA is introducing a new verification process when authorizing a representative using Represent a Client (RAC) beginning October 18, 2021 (see October 12 stakeholder email). This new process, called “Confirm my Representative,” will require individuals and businesses to verify who has access to their tax information by signing into My Account (MyA) or My Business Account (MyBA). Once a representative has made a request to be authorized or to increase the level of authorization through RAC, the taxpayer must verify the request online within ten business days for it to be accepted. The specific steps are highlighted in the email.

Please note that this new process applies only to new authorization requests submitted by representatives through RAC.

Another option for verification has been provided that applies to individuals only. When making the request in RAC, information from the individual’s notice of assessment for a return filed at least six months ago is included in the RAC submission. Although the individual will not need to verify the request in MyA, they may be contacted by the CRA to verify the request.

We previously passed along feedback to the CRA that many members found the verification call to clients from CRA to be problematic as clients may not answer the call from CRA, resulting in cancelled authorization requests. This new process is intended to address this issue while allowing for a second level of verification.

As a reminder, there are two other ways to authorize a representative which remain unchanged:

Efilers preparing tax returns

A registered electronic filer in good standing can submit an authorization request through their EFILE certified tax software for instant online access to an individual or business account. Before submitting an authorization request via EFILE, the taxpayer must sign a signature page and the representative must keep it in their records for six years following the date that the return was electronically filed.

When compared with the revised RAC approach, there are several key differences:

- the request is not subject to the CRA verification process discussed above

- the representative will not need to know whether their client has access to MyA or MyBA or has signed up for electronic notifications

- it will eliminate the potential need for the representative to follow up with clients should they delay signing into MyA or MyBA to complete the authorization

My Account (MyA) or My Business Account (MyBA)

Within MyA and MyBA, individuals and business owners can authorize a representative online, giving representatives immediate online access to an individual or a business account. The taxpayer will need the representative’s RepID, Business Number or GroupID (whichever is applicable) to provide the authorization. Authorizations made under this method will not require CRA verification. This method may work well for clients who are familiar with MyA or MyBA since it is a one-step process.

October 12, 2021

Update on the OECD’s Two Pillar Plan and contingent application of Canadian DST

OECD announcement

On October 8, 2021, the Organization for Economic Cooperation and Development (OECD) announced that 136 out of the 140 countries of the Inclusive Framework have agreed on the elements of its two-pillar plan on international tax reform. In particular, all G20 and OECD countries now support the plan.

Details from the agreed upon plan include:

- Pillar One will be applicable to multinational entities (MNEs) with global sales of 20 billion euro and profitability above 10 per cent, with 25 per cent of profit above the 10 per cent threshold to be reallocated to market jurisdictions. Countries will continue to develop and sign a multilateral convention (MLC) during 2022 to allow effective implementation in 2023. Of note, the MLC will require all parties to remove all Digital Services Taxes (DSTs), commit not to introduce such measures in the future, and that no newly enacted DSTs will be imposed on any company from October 8, and until the earlier of 31 December 2023 or the coming into force of the MLC.

- As part of Pillar Two, a 15 per cent global minimum corporate tax rate for MNEs whose global revenues exceed 750 million euro will apply. The 15 per cent minimum tax will be effective in 2023 and the OECD is developing model rules to bring Pillar Two into domestic legislation during 2022.

For more information, please see the OECD’s statement page, which provides various resources on the two pillars and the changes made.

Department of Finance response

In response, Finance Canada announced it will move ahead with legislation and finalize the enactment of a Digital Services Tax (DST) by January 1, 2022. The DST will only be imposed if the global agreement has not come into force by January 1, 2024. However, if the tax does apply, it will be applicable to revenues that arise on or after January 1, 2022.

This is a very unusual provision as affected corporations may be subject to a tax beginning on January 1, 2022 but will not know whether the tax has to be calculated and remitted until January 1, 2024. Similarly, the CRA will not know until early 2024 whether it needs to actually administer the tax. Although greater flexibility on timing is appreciated, this approach could create compliance costs for both corporations and the government for a tax that may not apply.

We will continue to provide updates as developments arise.

October 7, 2021

CRA releases revised Disability Tax Credit Form T2201 and a new digital application for medical practitioners

CRA has recently made changes to the Disability Tax Credit (DTC) application process. The key changes include:

- a significant revamp of Form T2201, Disability Tax Credit Certificate

- the launch of a new digital application that guides medical practitioners through the completion of Part B of Form T2201 and creates a completed form

- Form T2201, and any supporting documents can now be submitted using “Submit Documents” in My Account or Represent a Client

- updates to Guide RC4064 Disability-Related Information 2020

As a reminder, the Disability Tax Credit Promoters Restriction Act (DTCPRA) was enacted earlier this year and will limit the amount “promoters” can charge for preparing DTC claims to $100. The DTCPRA will come into force on November 15, 2021. In our discussions with the CRA, we outlined our key concerns with the new rules and asked for further clarity on the types of services that will be captured under the DTCPRA.

We will continue to keep you informed of developments in this area.

September 2021

September 23, 2021

Update on trust reporting proposals

In the 2018 federal budget, the government announced new reporting requirements that will apply to certain trusts. Under the proposals, affected trusts will be required to report the identity of all trustees, beneficiaries and settlors, as well as the identity of each person who has the ability to exert control over specific trustee decisions. Significant penalties can apply for non-compliance. These proposed rules were scheduled to apply to returns required to be filed for the 2021 and subsequent taxation years.

It should be noted that draft legislation for these proposals was released but has not been passed into law. Based on feedback received, many want to start the data collection process well before the 2021 T3 filing deadline and they have asked us whether we have any insight on when the CRA will provide details on what will be needed. We have asked the CRA whether they can release a draft version of the new T3 schedule that will have to be completed, or a list of the specific information that will be needed to complete the form. We are awaiting the CRA’s reply.

We will also follow up with the CRA on the status of T3 efiling as it was our understanding that it will be possible to efile most 2021 T3 returns which should make the filing of these returns and the additional required information easier.

Status of key announcements from the 2021 federal budget

When implementing changes announced in a federal budget, two bills are generally tabled in Parliament to enact the changes. Changes that require immediate enactment are generally included in the first bill, which is normally passed into law before Parliament adjourns for the summer (this year, it was Bill C-30, Budget Implementation Act, 2021, No. 1). The balance of the legislative changes is typically released as draft legislation during the summer and tabled in Parliament as a bill in the fall. However, legislation was not introduced for the remaining 2021 federal budget proposals before the election was called.

As there was not a change in the governing party, our expectation is that the government will follow through on their previous proposals and draft legislation will be released soon.

Some of the key proposals for which legislation has not been released include:

Income tax proposals:

- interest deductibility

- immediate expensing of capital expenditures

- rate reduction for zero-emission technology manufacturers

- CCA for clean energy equipment

- new mandatory disclosure requirements

- avoidance of tax debt rules

- hybrid mismatch arrangements

- electronic filing and certification of tax and information returns

Other taxes:

- tax on selected luxury goods

- digital services tax

- tax on unproductive use of Canadian housing by foreign non-resident owners

We will continue to track developments on these changes and provide updates as warranted.

September 22, 2021

Issue with CRA post assessment review letters

It recently came to our attention that some CRA post assessment review letters were being delivered directly to individual taxpayers instead of their authorized representatives despite instructions transmitted as part of the EFILE process. The main concern we have is that these taxpayers might assume their representative will respond to the letter, as they have historically. Since their representative is not receiving the letter, the required response may be late or even missed, resulting in a reassessment.

We passed this issue along to the CRA and they have indicated they have identified the source of the issue and are actively working to fix it. We understand that CRA agents will contact the representatives of the affected taxpayers before further compliance action is taken and an extension will be granted based on the date of this second contact attempt.

The CRA has also posted an item on their EFILE news and program updates webpage explaining the situation.

September 21, 2021

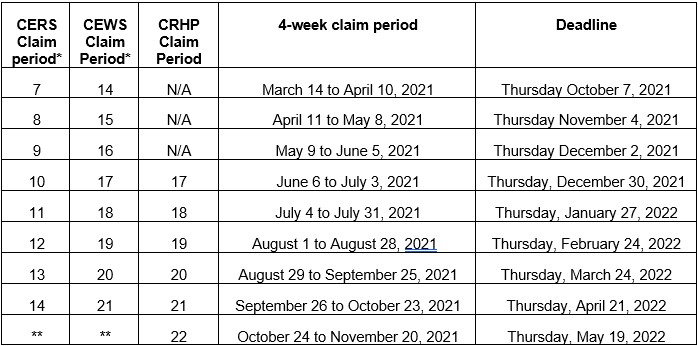

Reminder: Upcoming CERS, CEWS and CRHP deadlines

Given the significant workload this past year for practitioners, it is possible to lose sight of deadlines that are arising for three key COVID-19 programs: The Canada Emergency Rent Subsidy (CERS), the Canada Emergency Wage Subsidy (CEWS) and the Canada Recovery Hiring Program (CRHP). These deadlines are unlike most others in terms of what day they fall on and the implications of missing a deadline. Therefore, we wanted to provide you with a summary to help you track these key dates.

A CEWS, CRHP and CERS application must be filed no later than 180 days after the end of a claim period. The deadline to amend your application or increase the claim amount is also 180 days after the end of the claim period. Reductions can be requested after the deadline. The CRA also announced that they would allow certain late-filed claims and amendments – see the April 21 post “CRA announces they will accept certain late-filed CEWS and CERS applications” below. (Note that the CRA has indicated the conditions for accepting late CRHP applications are the same as CEWS). Note that we recommended to both the CRA and Finance Canada that the CRA should be allowed to use powers similar to those under the Taxpayer Relief program for late-filed CERS and CEWS claims. Unfortunately, there has been no legislative response to this request.

The upcoming deadlines to submit, amend or increase your clients’ CERS, CEWS and CRHP claims are as follows:

Key employment issues highlighted to CRA

As the pandemic continues to evolve there are number of important employment issues on which the CRA needs to provide guidance. Some of the key issues we have highlighted to the CRA include:

Will the pandemic rules apply for 2021?

The CRA will need to provide clarity on whether the “pandemic rules” it provided in 2020 will apply in 2021 and if so, how. For example:

- Will the CRA’s guidance on employer-provided benefits and allowances released on December 24, 2020 apply to 2021

- Does the $500 policy for home equipment apply for 2021? If so, will a separate $500 limit apply for 2021?

How will the home office expense deduction work for a hybrid work environment?

Many employers have re-opened their offices and are allowing their employees to work from home and the office. Under this hybrid work model, employers aren’t necessarily requiring their employees to work from home, rather they are allowing them to choose based on various considerations. That said, employers would have difficulty meeting social distancing and other pandemic requirements if all their employees were to return at once. All these issues pose various interpretative and administrative issues including:

- Whether employees are “required” to work from a hybrid work model is unclear. Can employers attest in an employee T2200 that they are required by their employment contract to maintain a workspace in their home where the employer and employee reach a mutual agreement? If yes, how will the CRA determine whether the employee worked principally from their home office?

- Determining the home office expense amount could get even more complicated with hybrid arrangements, so will the CRA continue to allow a flat rate method similar to the 2020 calculation?

- Will there again be a need for employers to issue two T2200s where an individual is working at home due to the pandemic but has other unrelated expenses requiring the regular T2200?

Will 2021 be notionally split in a manner similar to 2020?

The CRA will need to consider whether these employment issues should be dealt with under a combination of “normal rules” and “pandemic rules.” It seems to us that determining a specific end to the pandemic may be difficult and it may make sense to apply “pandemic rules” to the full year.

These are just a few issues we have raised to the CRA which were based on member feedback. We will continue to update you as we get more information.

Budget 2021 electronic notices of assessment proposal

The 2021 federal budget contained several proposals that will change how the CRA communicates with taxpayers and their representatives. In particular, significant issues and concerns have been identified with respect to the Notices of Assessments (NOAs) proposal.

The NOA proposal would provide the CRA with the ability to send certain NOAs electronically without the taxpayer having to authorize the CRA to do so. This proposal would apply in respect of individuals who file their own income tax return electronically through NETFILE and those who employ the services of a tax preparer that files their income tax return electronically through EFILE.

We’ll focus on taxpayers whose returns are submitted through EFILE.

Based on our discussions with the CRA, the changes planned are more far-reaching as we understand the plan is to completely eliminate the mailing of paper NOAs where a return is efiled. Under this plan, there will be two ways that these individuals can get their NOA:

- The individual can access the CRA’s My Account service, and view or download the NOA there

- The tax preparer will download and provide the NOA to the individual, presumably as some sort of requirement placed on tax preparers given the importance of making sure that taxpayers receive their NOA.

The CRA has indicated that the intention is to implement the NOA proposal before the 2022 T1 tax filing season for 2021 tax returns.

This is a significant change and there are fundamental concerns and issues that we believe need to be discussed and dealt with before implementation. We are concerned that the government’s implementation date does not allow sufficient time for a discussion on these issues, for software developers to update their products, if needed, and for tax preparers to adjust their business practices given that the final details have not yet been released.

We have made a submission to the government which urges the government to delay the implementation of the NOA proposal until the 2023 T1 tax filing season for 2022 returns. We have also provided a detailed summary of the concerns and questions around the NOA proposals as a basis for further discussions. We hope the next step in the government’s process is to consult with key stakeholders on the issues raised and to discuss solutions together along with providing the time needed for this work. We will continue to keep you updated as new developments arise.

September 2, 2021

Update on immediate expensing proposal for CCPCs

One proposed change in the 2021 federal budget would allow Canadian-Controlled Private Corporations (CCPCs) to immediately expense certain capital expenditures, effective for property acquired on or after April 19, 2021 and put into use before 2024. We have learned that the CRA will not allow the proposed deduction as legislation had not been introduced and they have disallowed the claim for some taxpayers. If and when the federal government moves forward with this proposal, it should be possible to file an amended return at that time to claim the deduction.

Regulations released for recent business support announcement

On September 1, regulations (see page 3766) were released for the Canada Recovery Hiring Program (CRHP), Canada Emergency Wage Subsidy (CEWS) and the Canada Emergency Rent Subsidy (CERS). The regulations deal with extension issues and also a technical change that will provide relief for newer employers using the general approach in situations that were outlined in the July 30 Department of Finance backgrounder.

August 2021

August 16, 2021

Update regarding communications during the federal election period

Please note that, with a federal election underway, a number of Elections Canada regulations are now in full force until the end of polling day (September 20), when Canadians vote. During the election period, these rules will have a direct impact on CPA Canada’s online content in relation to government or policy issues. As a result, we may not be able to communicate in the manner to which you have become accustomed.

August 3, 2021

More information on July 30 Finance Canada support programs announcement

In its July 30 announcement, Finance Canada introduced a change that will deal with a technical issue related to the revenue decline calculation for employers that are using the general approach for the Canada Recovery Hiring Program (CRHP), Canada Emergency Wage Subsidy (CEWS) and the Canada Emergency Rent Subsidy (CERS).

The issue was discussed in our recent webinar with the CRA on the CRHP. Under the general approach, an employer compares its current revenue with the same period before the pandemic. Once an approach is picked in period 5, then the employer must follow this approach for all remaining periods. In the question we asked the CRA, the employer was considering their claim for period 14 whereby revenue for March 2021 is compared with revenue for March 2019. This was problematic, as the employer in question was a new business that was commenced in May 2019. In its response, the CRA said that claiming the CEWS/CRHP in period 14 and subsequent periods would be problematic because the employer cannot switch to the alternative method. However, they also pointed out that the matter had been referred to Finance Canada.

Given the filing deadline for period 14 is October 7, there is a concern whether legislation will be enacted in time, and we will follow up with the CRA on how they plan to apply this change.

In addition to this change, the draft legislation also includes proposed amendments that will enact the June 2 Finance Canada announcement (see our June 3 news item).

July 2021

July 30, 2021

COVID-19 benefits and business supports extension and proposed changes

On July 30, 2021 the federal government announced the extension of COVID-19 support measures for individuals and businesses. These extensions include:

- extending the eligibility period for the Canada Emergency Wage Subsidy, the Canada Emergency Rent Subsidy and Lockdown Support until October 23, 2021, and increasing the rate of support employers and organizations can receive during the period between August 29 and September 25, 2021

- extending the Canada Recovery Benefit (CRB), the Canada Recovery Caregiving Benefit (CRCB), and the Canada Recovery Sickness Benefit (CRSB) until October 23, 2021

- increasing the maximum number of weeks available for the CRB, by an additional four weeks, to a total of 54 weeks, at a rate of $300 per week, and ensuring it is available to those who have exhausted their employment insurance (EI) benefits

The government is also proposing to offer businesses greater flexibility when calculating the revenue decline used to determine eligibility for the wage and rent subsidy programs and the new Canada Recovery Hiring Program. Further, it has released draft legislation that provides clarity on previously announced changes to the wage subsidy for furloughed employees.

More details on the extension and these proposed changes can be found in the government’s backgrounder.

July 27, 2021

Watch now: Canada Recovery Hiring Program (CRHP) webinar

CPA Canada co-hosted this webinar with the CRA focusing on the CRHP. During the webinar, the CRA provides an overview of the program and demonstrates their online CHRP tools and application portal. In addition, the CRA responded to some of the top questions that CPA Canada received on the CRHP.

July 26, 2021

CRA publishes guidance on remission review requests

The CRA has recently published guidance on its existing process for requesting a remission review, including information on:

- when to request a remission review

- how to make a request

- what happens after making a request

For further information, please refer to the CRA’s webpage.

July 23, 2021

Recent CERS rulings

The CRA recently provided some guidance with respect to the Canada Emergency Rent Subsidy (CERS) in two new technical interpretations:

Hotels

In Technical Interpretation 2020-0872521I, the CRA was asked whether the owner of a qualifying property that operates a hotel, or other similar business, would be considered to use its qualifying property primarily to earn rental income and therefore not eligible to claim the CERS for that qualifying property. While a question of fact, the CRA provides some helpful guidance. The CRA indicates that generally, any income earned from the use or occupation of a property is considered to be rental income. However, where an entity also provides significant additional services that are integral to the success of its ordinary activities, it is the CRA's position that the operation of that entity would be earning income from the services provided instead of rental income. Finally, in determining whether the qualifying property is used primarily to earn rental income, the CRA confirms that “primarily" generally means more than 50 per cent and that various factors, such as the proportion of time the property is used to earn rental income, or the proportion of space, in relation to the total area of the property that the property is used to earn rental income, may be used.

Contents insurance

In 2021-0893621E5, the CRA considers whether contents insurance is included in qualifying rent expense for the purposes of calculating the CERS. The CRA indicates that whether a particular payment for insurance made by an eligible entity in respect of a qualifying period is qualifying rent expense depends on the terms of the relevant insurance contract. Generally, if the insurance is on the qualifying property, then the amount paid for the insurance should be part of qualifying rent expense. In contrast, if the insurance is for content or personal property, then the amount paid for the insurance should not be included in qualifying rent expense.

July 21, 2021

Process for making a bulk taxpayer relief request released

The CRA has recently released guidance on how authorized representatives can make a bulk request for the cancellation of penalties and interest on behalf of multiple taxpayers, for which the request for relief have common reasons or similar facts. The CRA indicates the bulk request can be made with respect to penalties or interest under the Income Tax Act or the Excise Tax Act. When submitting a bulk request, representatives should ensure the following:

- authorization is on file for each taxpayer

- returns have been filed or remittances have been made

- penalties or interest have been charged

Further instructions can be found on the CRA’s webpage.

July 20, 2021

Revised news release: Bill C-208 and inter-generational transfers

The Department of Finance Canada issued a revised news release on July 19 on Bill C-208. The original release caused a significant amount of confusion and many questioned whether Finance Canada could change the coming into force date of the bill. The revised release sets out the federal government’s plans in more detail and the key highlights include:

Confirmation was provided that the bill is the law, and it currently applies as passed by Parliament.

Finance Canada believes that the bill allows for surplus stripping as it could apply where there is no genuine intention to transfer ownership of the business and as such, compromises the integrity of the tax system. In particular, reference is made to converting dividends into capital gains which are taxed at a lower rate. The same risk presumably applies to gains eligible for the capital gains exemption although that is not discussed specifically.

Further draft legislation will be released which will contain more rigorous rules that will deal with issues such as whether the new owners are active in the business. The goal will be to ensure that the rules are not used for “artificial tax planning.”

There will be a consultation on the proposals when they are released.

The final legislation will apply as of the later of either November 1, 2021 or the date of publication of the final draft legislation.

We will continue to monitor this issue and provide an update when there is new information.

Canada Recovery Hiring Program (CRHP) study: Participants needed

The CRA is seeking CPA participants for its CRHP study. The purpose of this study is to evaluate the web content, as well as the online calculator used in the CRHP application process. The study takes approximately 45 minutes. The study will be administered live by a User Experience Specialist and will focus on the CRHP application process to determine if and where participants may encounter/experience challenges.

If you are interested in participating, please take a moment to complete the CRA’s screener survey.

Upon completion of the survey, the CRA will contact selected participants regarding next steps.

July 7, 2021

Submit your questions now: Canada Recovery Hiring Program (CRHP)

CPA Canada is recording a webinar with the CRA focusing on the CRHP. During the webinar, the CRA will provide an overview of the program and demonstrate their online CHRP tools and application portal. In addition, the CRA will respond to some of the top questions that CPA Canada receives on the CRHP.

You can submit your questions on Slido (enter code #949225) until Sunday, July 11, 2021.

A recording of this webinar will be available on this page after July 14, 2021.

Update on Bill C-208: Intergenerational transfers

Bill C-208, which was a private member’s bill aimed at the issue of tax inequity for non-arm’s length intergenerational transfers of a business, received Royal Assent on June 29. When selling a corporation to another arm’s-length corporation, it is generally possible to realize a capital gain and if the shares qualify, a gain eligible for the capital gains exemption. However, if the same shares are sold to a non-arm’s length corporation, such a gain could be deemed to be a dividend under Section 84.1 of the Income Tax Act. Bill C-208 sought to eliminate this inequity.

Bill C-208 changed the rules that apply to non-arm’s length sales so that deemed dividend treatment would not apply if certain conditions are met. As the bill was considered by Parliament, the Department of Finance Canada expressed concerns that the draft changes could allow for inappropriate surplus stripping. Due to this, on June 30, Finance Canada announced that:

"The federal government is committed to facilitating genuine intergenerational share transfers, while preventing tax avoidance that undermines the equity of Canada’s tax system. The government proposes to introduce legislation to clarify that these amendments would apply at the beginning of the next taxation year, starting on January 1, 2022."

We will continue to monitor this issue and provide more information as it becomes available.

June 2021

June 30, 2021

GST/HST registration for digital economy businesses now available

On June 29, Bill C-30 (Budget Implementation Act, 2021, No.1) received royal assent and the new GST/HST rules for digital economy businesses will be in effect on July 1. On June 30, the CRA launched its new registration system and is now accepting GST/HST registration requests under these new measures.

New Canada Recovery Hiring Program (CRHP) web page and calculator now available

On June 30, the CRA launched its CRHP online calculator and web page to help eligible employers prepare their CRHP applications.

The online calculator integrates the new CRHP with the Canada Emergency Wage Subsidy (CEWS), automatically showing applicants which subsidy will provide them with more support based on the information they enter. The CRHP web page includes detailed information about eligibility requirements, how payment periods are structured and how the CRHP is calculated.

Eligible employers will be able to apply for the CRHP starting July 7 through My Business Account and Represent a Client. The CRA will begin to issue CRHP payments to eligible employers during the week of July 12.

June 17, 2021

Update on simplified GST/HST registrations

The CRA has updated their webpage to indicate that they will now be opening the simplified GST/HST registration site for digital businesses on June 25, 2021 (previously June 21, 2021).

In addition, we wanted to highlight that the CRA indicates in their guidance that “a person other than the business owner, such as an accountant, lawyer or another company employee, can submit the registration form on behalf of the business.” We confirmed with the CRA that the representative does not need to be authorized to submit a request for registration under this approach. The CRA indicated, however, that after the registration is complete, a representative will have to provide proper authorization for any further communication with the CRA.

June 10, 2021

CRA to open simplified GST/HST registration for digital businesses on June 21, 2021

The CRA has recently updated their webpages relating to the new GST/HST obligations under the proposed measures that were announced by the Government of Canada last fall. The webpages include several tools and resources to help businesses determine if they need to register under the new regime, the options for GST/HST registration, determining place of supply, and what the compliance obligations are. Of note, the CRA has announced that the simplified registration site will open on June 21, 2021.

Lockdown support for closed travel agencies, stores, and food court restaurants

Two recently published technical interpretations, 2020-0873601I7 and 2021-0880401I7, deal with whether various mandated closures would qualify for lockdown support. The scenarios presented to the CRA were:

- a travel agency, which was required to close its office due to lockdown measures in effect in the city where it is located, but employees were able to perform their duties from home

- a retail store located in a shopping mall where a public health order mandates the closure of the store for in-person shopping but may provide sales online or by phone via curbside pick-up or delivery

- a food court restaurant in a shopping mall where a public health order requires the closure of the food court seating area

In its responses, the CRA provides a useful analysis of the various conditions of “public health restriction” under subsection 125.7(1). Of particular note, the CRA indicates that in determining whether a public health restriction requires that some or all of the activities of the eligible entity at the qualifying property are required to cease (i.e., "restricted activities"), the CRA provides that this determination is based on the type of activity rather than the extent to which an activity may be performed, or limits placed on the time during which an activity may be performed.

The CRA also notes that for a particular order to meet the conditions of a public health restriction under subsection 125.7(1), it requires that it is reasonable to conclude that at least approximately 25 per cent of the qualifying revenues of the eligible entity for the prior reference period that were earned from the qualifying property were derived from the restricted activities. The CRA indicates that the entity may have some flexibility in the method it can use to satisfy this condition, provided that it is appropriate for those particular circumstances.

Thus, in the case of a travel agency, if, prior to the closure, clients made in-person visits to the office to arrange travel bookings and in-person visits ceased upon closure of the office as the result of an order or decision, then those activities could be considered restricted activities and this condition could be satisfied. The fact that employees started working from home and started making travel bookings over the phone once the office closed would not preclude this condition from being met. The CRA applies this same rationale for the closed store in the shopping mall but still providing curbside pickup or delivery for its customers (i.e., the in-person shopping could be considered the restricted activity).

For the food court restaurant, where the public seating areas for customers of the restaurant are required to be closed, the CRA indicates that the "sit-down dining" activities could be considered restricted activities, and the fact that take-out service may continue would not preclude the restaurants from having restricted activities related to "sit-down dining". It is not clear to us how the 25 per cent of revenues condition noted above would be documented in this situation.

Finally, the CRA re-confirms that for the condition that the restricted activities are required to cease for a period of at least one week, there is no requirement this must be within a particular qualifying period.

June 9, 2021

CRA confirms federal SR&ED extension does not apply to British Columbia or Nova Scotia R&D claims

Further to our post on June 8, 2021, the CRA has now published its guidance on the impact of the federal Scientific Research and Experimental Development (SR&ED) extension to provincial R&D claims. The guidance specifically indicates that the federal extension does not apply to the British Columbia Scientific Research and Experimental Development Tax Credit and Nova Scotia Research and Development Tax Credit. As noted in our earlier post, the CRA recommends that affected corporations should file their federal and provincial claim forms without taking into account the federal COVID-19 extension.

June 8, 2021

SR&ED extension to September 1, 2021 for certain corporations

The CRA updated their Scientific Research and Experimental Development (SR&ED) Filing Requirements Policy in November 2020 to reflect legislative changes that had been announced and the extension of SR&ED reporting deadlines because of the COVID-19 pandemic. Appendix A of the policy provides a table which summarizes the CRA’s extensions to SR&ED filing deadlines. Of note, the table in section A.1 indicates that because the T2 filing due date for corporations with taxation year-ends from November 30, 2019, to February 29, 2020 were extended to September 1, 2020, the federal SR&ED reporting deadlines for these tax years have been extended to September 1, 2021. The CRA has reconfirmed that these due dates still apply.

We asked the CRA to confirm how this extension would apply to provincial and territorial research and development (R&D) credits. The CRA has indicated that in general, for provinces where the wording in their respective tax Acts for their R&D reporting deadline does not rely on the filing due date, the deadlines for the provincial R&D credit are not extended. The CRA recommends that such taxpayers should file their federal and provincial claim forms without taking into account the federal COVID-19 extension.

For provinces administered by the CRA that have the same or similar wording in their provincial income tax Acts, such as “12 months (or one year) after the taxpayer’s filing due date,” the CRA stated that the deadline to file for these R&D tax credits is extended in the same way as the extended federal SR&ED reporting deadline.

Please see the CRA’s Summary of provincial and territorial research and development (R&D) tax credits for further information on the deadlines that apply for each province or territory administered by the CRA.

We understand that the CRA will be publishing guidance on this issue on their website shortly and we have suggested that they confirm the due dates that apply in each province or territory.

June 3, 2021

Details of the New Canada Recovery Hiring Program and extension of business support programs released

On June 2, the Government of Canada released backgrounders providing details on the Canada Recovery Hiring Program, as well as on the extension and changes to the Canada Emergency Wage Subsidy and Canada Emergency Rent Subsidy programs as announced in the 2021 federal budget. It appears that the details contained in the backgrounders are consistent with what was in the budget documents.

May 2021

May 27, 2021

CRA publishes new technical interpretations on COVID-19 relief programs

The CRA continues to publish technical interpretations providing additional guidance related to the Canada Emergency Rent Subsidy (CERS) and the Canada Emergency Wage Subsidy (CEWS):

Owner-manager remuneration and CEWS

In CRA technical interpretation 2020-0865791I7(E), the CRA was asked to comment on whether certain amounts paid or credited by an eligible entity to an eligible employee, who is an owner-manager, are considered eligible remuneration for purposes of CEWS in a number of different scenarios.

The CRA confirmed that salary and wages paid to an owner-manager retroactively in respect of a week during a qualifying period can generally be considered eligible remuneration for purposes of the CEWS to the extent that the eligible remuneration reflects the actual amount paid in respect of the particular claim period. However, in the situation where an owner-manager’s salary expense is reflected by journal entry only, with a corresponding credit to the shareholder account, the CRA appears to indicate that such salaries and wages are not considered eligible remuneration. Finally, if the corporation pays the salaries and wages to an owner-manager which are then immediately returned to the eligible employer as either a shareholder loan or capital contribution, the amounts will not qualify as eligible remuneration for purposes of the CEWS.

We will be following up on the CRA’s comments with respect to remuneration credited to a shareholder loan account to clarify whether the comments relate to the specific situation in the interpretation or the practice of crediting salary amounts to a shareholder loan account more generally.

Claiming a lesser CEWS amount possible

In CRA technical interpretation 2020-0850231E5 (E), the CRA was asked whether an eligible entity can submit a CEWS application for a lesser amount than that determined by the formula in the Income Tax Act. The CRA indicated that since the Act calculates the subsidy amount for an eligible employee in respect of a week in the qualifying period, the qualifying entity has discretion to claim a lesser amount in its application by excluding any employees from the CEWS calculation under the Act.

Rent paid for a boat slip may qualify for CERS

Technical interpretation 2021-0875571I7(E) deals with whether a boat slip is considered real or immovable property such that rental expenses for the boat slip qualify for CERS. The CRA provides general comments and indicates that the taxpayer should look to common law principles (or the Civil Code of Quebec if the property was located in Quebec) to determine whether a particular property, such as a boat slip, would be considered real or immovable property.

CRA publishes guidance on how to tell if you’ve been contacted by the CRA

On May 26, 2021 the CRA published guidance that could help your clients determine whether they have been contacted by a legitimate CRA agent. To help protect your clients from scams, it’s important that they know when and how the CRA might contact them, especially as personal income tax return verifications resume.

May 25, 2021

CERS online calculator fixed for lockdown support

The CRA has made changes to the CERS online calculator regarding the calculation of lockdown support. See our April 14, 2021 posting for further details on the issue with the calculator. The CERS webpage now clarifies that if a lockdown period is one week or longer, a business may qualify for lockdown support even if the minimum lockdown period of one week overlaps two different claim periods.

The CRA notes that if the CERS calculator was used on or before May 20, 2021, it may not have accurately calculated lockdown support if the lockdown period overlapped two or more claim periods.

CRA publishes new technical interpretations on COVID-19 relief programs

The CRA has recently published a number of technical interpretations providing some new guidance related to the Canada Emergency Rent Subsidy (CERS) and the Canada Emergency Wage Subsidy (CEWS):

Guidance on “qualifying property” for CERS

In CRA technical interpretation 2020-0870041I7 (E), the CRA is asked whether the determination of a qualifying property depends on its legal title. The CRA was also asked whether a property that contains a self-contained domestic establishment (SCDE) can be a qualifying property for the purposes of the CERS.

The CRA concludes that while the legal title of a property may be relevant in determining whether a particular property is a qualifying property, it is not necessarily the case that a qualifying property of an eligible entity will always conform to its legal title. As such, a single legal title may, depending on the circumstances, contain more than one qualifying property. Similarly, a particular property may be a "qualifying property" for more than one eligible entity.

On SCDEs, the CRA indicates that the definition of qualifying property excludes property that is a SCDE used by the eligible entity. However, in some situations, a particular property may include a portion that is subject to the SCDE exclusion in the definition of qualifying property. In such a case, the fact that a part of a property is excluded may not, depending on the circumstances, preclude the remaining part of the property from being a qualifying property.

Rent on barber/hairdresser chairs may be eligible for CERS

In Technical Interpretation 2020-0869981I7 (E), the CRA indicates that where a barber or hairdresser (the “Stylist”) rents or leases space, a chair, or both, from the owner of a barbering or hairdressing establishment (the “Salon”), the rent may be claimed as a "qualifying rent expense" for the purposes of the CERS. The CRA provides that since the "chair rent" is rent for the use of, or right to use, an area within the salon that is real or immovable property such that it is capable of being a qualifying property, it may be a qualifying rent expense for the stylist, provided all of the conditions in the definition of qualifying rent expense are met. The CRA notes that this is a question of fact that must be determined by considering all of the circumstances of a particular situation, including the particular written agreement between the stylist and the landlord.

Business interruption insurance proceeds is qualifying revenue for CEWS

Technical Interpretation 2020-0852571I7 (E) deals with whether amounts received by an eligible entity from a business interruption insurance policy is included in an entity's qualifying revenue for purposes of the CEWS. The CRA indicates that since an entity would typically acquire business interruption insurance to replace lost revenue when the entity is unable to carry on its ordinary activities, insurance proceeds would generally be included in qualifying revenue and would not be considered an extraordinary item. The CRA was also asked where such insurance proceeds are included in revenue in a prior period, and are based on a gross revenue benchmark less cost of sales, whether an eligible entity can determine their qualifying revenue for the particular prior reference period based on the insurance proceeds plus a notional amount to represent what their revenue would have been during this period had they been able to operate. The CRA indicates that, since only amounts resulting in an inflow of cash, receivables or other consideration are included in qualifying revenue, therefore, an eligible entity would not be able to gross up their qualifying revenue by a notional amount.

May 18, 2021

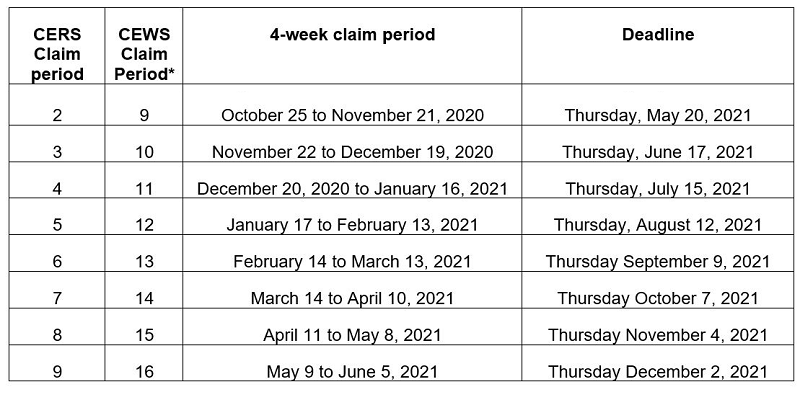

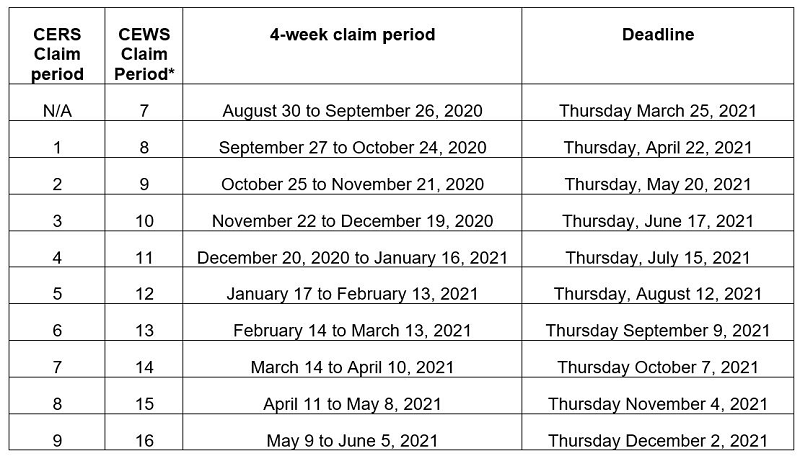

Reminder: Upcoming CERS and CEWS deadlines

Given the significant workload this past year for practitioners, it is possible to lose sight of deadlines that are arising for two key COVID-19 programs – The Canada Emergency Rent Subsidy (CERS) and the Canada Emergency Wage Subsidy (CEWS). These deadlines are unlike most others in terms of what day they fall on and the implications of missing a deadline. Therefore, we wanted to provide you with a summary to help you track these key dates.

A CEWS and CERS application must be filed no later than 180 days after the end of a claim period. The deadline to amend your application or increase the claim amount is also 180 days after the end of the claim period. Reductions can be requested after the deadline. The CRA also announced that they would allow certain late-filed claims and amendments – see the April 21 post “CRA announces they will accept certain late-filed CEWS and CERS applications” below. Note that we recommended to both the CRA and Finance Canada that the CRA should be allowed to use powers similar to those under the Taxpayer Relief program for late-filed CERS and CEWS claims.

The upcoming deadlines to submit, amend or increase your clients’ CEWS and CERS claims are as follows:

*CEWS claim periods 1 to 8 and CERS claim period 1 are closed.

May 10, 2021

CRA publishes guidance on new digital economy GST/HST measures

As of July 1, 2021, digital economy businesses may have GST/HST obligations under proposed measures that were announced by the Government of Canada last fall. To help affected businesses prepare for their new compliance obligations, the CRA has launched a new webpage which includes a questionnaire to help businesses determine if they need to register under the new regime, as well as instructions and examples.

The federal government had announced in the 2021 federal budget that the CRA will work closely with businesses to assist them in meeting their obligations. The CRA notes on their webpage that where the affected businesses and platform operators show that they have taken reasonable measures but are unable to meet their new obligations for operational reasons, the CRA will take a practical approach to compliance and exercise discretion in administering these measures during a 12-month transition period, starting July 1, 2021.

May 7, 2021

Update on discussions with the CRA on 2020 tax returns

As discussed in our April 27 update, while we are disappointed with the federal government’s decision to not provide an extension for personal tax returns, we are continuing our discussions with the CRA on issues related to personal tax returns and tax deadlines. Issues discussed with the CRA include the following:

Taxpayer relief

We recommended that the CRA provide clear guidance on situations where relief will be provided for late-filed T1 returns through the Taxpayer Relief Program. Also, the process for requesting relief should be as simple as possible on the assumption that the number of requests for relief will be larger than normal. Some specific suggestions include:

- Determine whether there are situations where “proactive relief” could be provided by the CRA without an application made by the taxpayer, such as for those taxpayers who have filed on time in prior years. Such an approach could also be used for smaller amounts.

- For tax preparers, to the extent that proactive relief is not available, allow them to submit a list of relief requests to streamline the process.

- Look for other ways to simplify and speed up the process.

CRA verification processes

We asked the CRA to keep in mind that many incomplete T1 returns may have been filed since no extension was allowed and that it should expect that it will take more time to finalize these returns through T1 adjustments. We also reminded the CRA that other significant deadlines are approaching on June 15 for T1s for the self-employed (and spouses/partners) and June 30 for T2s for corporations with a calendar year end. Consequently, the workloads of many firms remain high. With this in mind, we asked the CRA to delay verification work until after June 30 where possible.

Corporate tax return deadlines

On corporate tax returns, the province of Quebec has announced that relief similar to that provided to individuals is not planned and we assume the same will be true federally for T2 returns. Since relief for corporations will likely need to come through the Taxpayer Relief Program, we will discuss how this program will be administered for late-filed corporate tax returns with the CRA.

Finance publishes explanatory notes for the 2021 budget bill

Finance Canada has recently updated their website to include the explanatory notes for the proposals included in Bill C-30 (which includes certain Budget 2021 measures and other previously announced measures).

May 3, 2021

Government introduces Bill C-30

On April 30, 2021, the federal government introduced Bill C-30, an Act to implement certain provisions of the budget tabled in Parliament on April 19, 2021, and other measures. As mentioned in our previous post, this bill contains some of the measures introduced in the 2021 federal budget, as well as some other previously announced measures.

April 2021

April 30, 2021

Government tables Notice of Ways and Means Motion to implement certain 2021 budget proposals and other measures

On April 28, 2021, a Notice of Ways and Means Motion (NWMM) was tabled to implement some of the proposals included in the 2021 federal budget. It also includes a number of other previously announced measures, such as:

- changes to the tax treatment of employee stock options

- GST/HST measures on e-commerce supplies

- temporary adjustments to the automobile standby charge to take into account COVID-19

- changes to the Canada Emergency Wage Subsidy and Canada Emergency Rent Subsidy programs

For further details, please see the NWMM.

April 27, 2021

Update on April 30 filing deadline for personal tax returns

As April 30 draws nearer, the federal government has not announced an extension or other general relief. As we discussed previously on this page, we have communicated the need for such action in a number of ways to the federal government and at different levels for several months. Others, including the federal opposition and the Quebec government, also asked the Government of Canada for an extension or an advance waiver of penalties and interest. The issue also has been addressed in the media, in emails from members to their MPs, and in an online petition. We will continue to communicate with the CRA, including discussions on providing efficient and timely relief in the event that penalties are charged.

For self-employed individuals and their partners, the filing deadline remains June 15 and amounts owing are due April 30.

As stated on its website, the CRA intends to charge taxpayers a late-filing penalty if they file their 2020 tax return after April 30, 2021 and there is unpaid tax at that time. The penalty is five per cent of the balance owing for 2020, plus one per cent of the balance owing for each full month the return was filed after April 30, 2021, to a maximum of 12 months. A higher penalty applies if a return was late-filed in the prior three years. Interest will also be charged on unpaid amounts subject to the one-year relief program available to certain taxpayers. As the website for that program states, this relief does not apply to late-filing penalties. We understand that the penalty and interest assessment process is automated for the most part.

Relief can be provided under the taxpayer relief program. However, as individual applications are required, we have started to communicate with the CRA specifically on finding alternatives to reverse penalties and interest that are charged, and to do so as quickly as possible while minimizing the work that needs to be done by taxpayers and their advisors.

While we are disappointed with the federal government’s decision, we are committed to continuing to work with the CRA and Finance Canada in relaying ongoing concerns and providing relevant and timely updates as new information becomes available.

CRA provides examples for their guidance on international income tax issues

The CRA has updated their Guidance on International Income Tax Issues Raised by the COVID-19 Crisis with a number of examples that help to provide further clarification on how they will manage administrative relief for cross-border workers in respect of their 2020 Canadian income tax obligations. Many of the added examples are consistent with the questions we posed to the CRA and highlighted in our April 21, 2021 news posting, “CRA provides additional guidance on cross border tax issues.”

Reporting COVID-19 benefit repayments on 2020 personal tax returns

As you may be aware, the 2021 federal budget included a proposal to allow individuals to claim COVID-19 benefit repayments as a deduction in either the year they received the benefit or the year they repaid it. This option would be available for benefit amounts repaid at any time before 2023, including benefits received in 2020. We asked the CRA to confirm how repayments of 2020 benefits in 2021 should be handled.

The CRA has confirmed that if a taxpayer makes a repayment in respect of 2020 benefits in 2021 prior to filing their 2020 return, they can claim the deduction on line 23200 (other deductions). Alternatively, an adjustment to their 2020 return can be requested later once the repayment is made, provided that the repayment occurs before 2023. The CRA notes that they will hold any adjustment requests in abeyance until the proposed legislation receives Royal Assent.

April 21, 2021

CRA announces they will accept certain late-filed CEWS and CERS applications

On April 21, 2022, the CRA added questions 26-01 and 26-02 on their CEWS FAQ page. The CRA has provided guidance on the circumstances where it will accept late-filed amended or original CEWS applications.

In addition, the Canada Emergency Rent Subsidy (CERS) webpage has been updated to reflect that the CRA will also accept late-filed CERS claims under the same circumstances as provided for late-filed CEWS applications. Please review the CRA's CEWS FAQs and CERS webpage for further details.

CRA provides additional guidance on cross border tax issues

CPA Canada submitted a list of questions to the CRA which were gathered from members relating to our April 1 update of the CRA’s Guidance on International Income Tax Issues Raised by the COVID-19 Crisis. The questions have been reviewed and the CRA has provided responses to us which we are able to share. It is unclear at this time whether these questions and answers will be posted on the CRA website.

April 19, 2021

On April 19, 2021, Deputy Prime Minister and Minister of Finance Chrystia Freeland tabled Canada’s federal budget. Read CPA Canada’s Federal Budget Tax Highlights to learn about the most important tax changes announced this year.

April 16, 2021

Status of discussions with the federal government on the personal tax deadline

With the announcement of filing relief in Quebec, we have again been communicating to the federal government on the urgent issues surrounding the April 30 personal tax deadline. To provide you with more information and background on the steps we have taken, we have produced a short video to bring you up to date.

April 15, 2021

Quebec announces personal tax return relief

On April 15, Quebec’s Finance Minister announced relief for personal tax returns. According to the news release (available in French only), Revenu Quebec will provide flexibility and, in particular, returns can now be filed on or before May 31 without the application of a late filing penalty. Also, interest will not be charged on balances owing during May.

Although the federal government has still not provided relief and the April 30 federal deadline still stands, we will continue to communicate with the federal government, including the offices of the Minister of Revenue and Finance. We will be in touch with them again given the developments in Quebec, with the hope that they will follow Quebec’s announcement.

April 14, 2021