A path forward for the profession: Your questions answered

Updated February 15, 2024

CPA Canada is embarking on a period of profound change in order to position our organization for long-term sustainability and continued support of all Canadian CPAs.

After conducting a comprehensive organizational review to prepare for a new reality following the impending withdrawals of CPA Ontario and CPA Quebec, we've made the decision to restructure our workforce to realign with the anticipated future needs of our profession.

These decisions, while extremely difficult, reflect our commitment to sustain a vibrant and thriving national organization through a transformational period for the Canadian accounting profession.

As we look to the future, CPA Canada firmly believes that members’ voices should be front and centre in shaping our new strategic direction.

We continue to work with the remaining PTBs on what CPA Canada will look like going forward. We have heard that they very much value our contribution to the profession.

We have also heard resoundingly about the value members place on the importance of our role in supporting the profession. Fully 89 per cent of CPA members reaffirmed the need for a strong national accounting body in a recent independent membership poll conducted on behalf of CPA Canada.

Over the coming months, CPA Canada will build our new vision with the help of members, the PTBs and other stakeholders. We believe this will only strengthen our value proposition to the entire profession.

As always, we are committed to transparent and timely communication with members and will update you via this FAQ and other channels as soon as possible when there are new developments.

Thank you for your ongoing support and understanding.

Q: What is currently happening at CPA Canada?

Q. What does this mean for members?

Q. How is the role of CPA Canada different from the provincial bodies?

Q. Why did this happen? What are the main sticking points?

Q. Why is a national CPA organization important?

Q: How will the proposed withdrawal of Ontario and Québec impact the dues of the remaining members?

Q: How does the oversight of CPA Canada work?

Q. Does CPA Canada see a path forward for a unified profession?

Q: WHAT IS CURRENTLY HAPPENING AT CPA CANADA?

CPA Ontario and CPA Quebec’s pending withdrawal from the Collaboration Accord and CPA Canada triggered a review of our organizational landscape, which resulted in the necessary decision to streamline in order to position CPA Canada for long-term sustainability.

This means restructuring and realigning our workforce to best serve our profession in light of this new reality.

Unfortunately, these difficult decisions impact 20 per cent of our workforce, excluding our Standards team.

We are fully committed to providing support for our valued colleagues throughout this transition.

The CPA Canada team has been the backbone of our support for members and the profession. We have the deepest appreciation for the hard work, dedication, and contributions of every individual, including the talented professionals leaving our organization.

It is, of course, a disappointing outcome – we know that CPAs highly value the importance of a Canadian accounting organization, and we diligently pursued an outcome that would maintain the unity of the national profession. However, it is now clear that the withdrawing provincial bodies are resolute, and we must prepare for a new reality.

Q. WHAT DOES THIS MEAN FOR MEMBERS?

CPA members are our priority and we will continue the support we offer to them. Going forward, we will communicate transparently about any changes that may occur.

Longer-term, we believe these operational adjustments are necessary to navigate the evolving industry, to focus on supporting members and advancing the profession nationally and internationally.

While navigating these changes, we will work with Canadian CPAs across the country to inform the next steps as we work toward a future model that best serves the interests of all Canadian CPA members.

Q: WHAT IS THE FUTURE OF THE NATIONAL PRE-CERTIFICATION PROGRAM? DID THE INTENTION TO WITHDRAW ARISE AS A RESULT OF THE NEW CERTIFICATION PROGRAM?

It’s important to note that the new certification program was not part of the discussions about the governance of the profession. The development of the program has been driven by the provincial, territorial, and Bermudian bodies with the support of CPA Canada, which has dedicated resources and expertise. It is a separate and ongoing process.

We have reached an agreement with CPA Ontario and CPA Quebec that signifies our commitment to maintaining the current education path for aspiring CPAs across the nation. Under the agreement, CPA Canada will continue to develop the curriculum and examinations for the Preparatory courses (PREP) in Ontario, and the CPA Professional Education Program (PEP) and Common Final Examination (CFE) in Ontario and Quebec. This agreement not only preserves the integrity of our education system but also signifies a unified front in promoting the highest standards of excellence and rigour with consistency across Canada. It exemplifies a dedication to fostering a seamless and unified approach to education. This commitment is rooted in our common belief that a cohesive educational framework is crucial for upholding the highest standards of integrity among students from coast to coast to coast.

In finding workable terms, we have successfully crafted a fair and equitable solution that not only benefits the students but also serves the interests of all the provincial, territorial, and Bermudian bodies. This agreement reinforces CPA Canada's pivotal role in shaping the future of education beyond the 18-month withdrawal period ending in 2024.

We understand the significance of an effective education pathway for both students and provincial bodies. The terms agreed upon for the future of education underscore our shared goals of maintaining and elevating the standards of the accounting profession.

It is abundantly clear that this agreement is in the best interests of aspiring CPAs, ensuring a robust foundation for their future success.

Q. HOW IS THE ROLE OF CPA CANADA DIFFERENT FROM THE PROVINCIAL BODIES?

CPA Canada is a not-for-profit organization that represents the Canadian accounting profession at the national and international levels.

Like many other national professional organizations that are provincially regulated, CPA Canada is composed of members of provinces and territories and carries a different mandate than provincial bodies. CPA Canada has two classes of members—organizational members and individual members. In order to be an individual member of CPA Canada, a CPA must be a member in good standing with their provincial or territorial body, which is also an organizational member.

The mandates of provincial, territorial and Bermudian bodies vary, but are consistently grounded in their mandates as the qualifying and regulatory bodies responsible for protecting the public by governing the profession within their respective jurisdictions. These organizations ensure CPAs in their jurisdictions meet the profession’s high standards of qualification and enforce their codes of professional conduct. Their responsibilities include, but are not limited to, member management, setting and enforcing ethical rules, enforcing practice standards and investigating and adjudicating complaints.

CPA Canada’s mandate is to act in the public interest by promoting transparency in financial markets, providing extensive guidance and programming to members and contributing to standard setting and public policy in Canada and worldwide.

Here's a closer look at what CPA Canada does:

Supporting an independent, efficient and effective standard-setting system and enhancing Canada’s position as a leader in global accounting, assurance and sustainability standards

- Providing funding, staffing, translation, and other resources for Canadian and international accounting and assurance standards boards.

- Supporting international sustainability standards, including leading a coalition of Canadian champions to bring a second global headquarters of the International Sustainability Standards Board to Montreal and providing resources for the establishment of the Canadian Sustainability Standards Board.

- Continuing stewardship and publication of the CPA Canada Handbook, which provides guidance on accounting, audit and assurance standards.

- Influencing the development of international accounting, assurance and sustainability standards to ensure the Canadian CPA perspective is heard, achieved through consultations with members and experts across the country and engagement with policymakers, regulators and international standard-setting bodies including the IFRS Foundation and the International Federation of Accountants.

Acting as a strong, consistent and authoritative voice for the profession to elevate the Canadian CPA profession’s leadership in national and global affairs

- Helping to shape the Canadian tax and financial systems through consultations with federal government institutions and regulatory authorities, such as the Canada Revenue Agency and the Canadian Securities Administrators, as well as participating in pre-budget consultations, intervening in Supreme Court cases and representing the profession in parliamentary committees.

- Negotiating on behalf of Canadian CPAs in reciprocity agreements with international accounting groups, allowing members greater credential recognition, mobility and career opportunities globally.

- Enhancing the impact and influence of Canadian CPAs by working with global peers to advance the global accounting profession as a member of the Global Accounting Alliance and the International Federation of Accountants, as well as providing guidance to international committees including the Financial Action Task Force, the Organization for Economic Co-operation and Development and the B20 Business Summit.

Developing learner-centric education to cultivate qualified and competent CPAs fully equipped to meet the needs of the future

- Creating the Professional Education Program and preparatory courses as well as the Common Final Examination to ensure education and qualification is uniform, consistent and co-ordinated across the country.

- Co-ordinating the practical experience component of the CPA certification program, developing the practical experience strategy and collaboratively developing and supporting national requirements and policies to ensure equivalency across jurisdictions.

- Supporting the work of the provincial, territorial and Bermudian partners in the development of the new CPA Certification Program, dedicating resources and expertise in key areas, including curriculum development and education technology.

- Developing and administering the national in-depth tax program, the most comprehensive and practical tax training available in Canada, globally recognized by employers seeking demonstrated tax expertise.

- Programming nationally recognized continuing education for members and other finance professionals—including in-depth and technical programs and certificates, webinars and conferences such as the ONE, the ESG Symposium and the Public Sector Conference.

Investing in research and thought leadership that helps members build professional competency and proficiency, advancing the profession and enhancing the reputation of the CPA designation

- Sharing exclusive research and insights in economics and other priority areas—including sustainability, data and AI governance—that enhance members’ ability to build awareness and knowledge of emerging issues and provide valuable insights to clients and employers.

- Providing timely and consistent guidance and related resources about changes to Canada’s tax system and navigating new and complex accounting, audit, assurance and sustainability standards, as well as methodology guides.

- Marshalling a network of more than 7,300 CPA volunteers across the country to enable them to give back to their communities through initiatives such as the CPA Martin Mentorship Program for Indigenous students, the financial literacy program offered jointly with our regional CPA partners and opportunities to serve on one of the profession’s many boards, committees and working groups.

Q. WHY DID THIS HAPPEN? WHAT ARE THE MAIN STICKING POINTS?

Provincial, territorial and Bermudian bodies have been engaged with CPA Canada in a governance review for the past five years. Effectively, the discussions are about how decisions should be made in the context of the provincial legislative requirements, which create the profession, and the agreement, as stated at unification, that we all benefit by doing some important work together.

After five years of governance discussions, CPA Ontario and the Ordre des CPA du Québec asked CPA Canada this past spring to engage in separate conversations so an agreement could be reached that could be presented to the other provincial, territorial and Bermudian partners. With the endorsement of all of our partners, we sat down directly with them.

The two withdrawing provinces sought agreement on three principles:

- Increased and direct oversight of the profession by the provincial, territorial and Bermudian bodies

- Changes to the governance structure to eliminate individual membership

- Increased accountability and transparency

We agreed to work with these principles, subject to:

- Developing a workable approach to further enhancing financial transparency

- Consultation with CPA bodies and individual CPAs

We believe consultation with CPA bodies, individual CPAs and significant stakeholders is vital. There were several proposals that CPA Canada could not, in good faith, agree to without consultation because those demands impacted individual CPA members and other regional CPA bodies. We believe agreement on these matters can only be achieved after those bodies consult with their boards and membership.

A particularly important example is the proposal to eliminate CPA Canada’s individual members. CPA Canada has two classes of members—organizational members (the regional bodies) and individual members (CPAs). Currently, in order to be an individual member of CPA Canada, you must be a member in good standing with your provincial or territorial body. The proposed changes would mean individual CPAs would no longer be members of CPA Canada.

We believe that a change of such magnitude can only be made after testing it with individual CPAs and the other provincial, territorial and Bermudian partners. CPA Ontario and CPA Quebec disagreed, indicating their conviction that the governors of the profession could and should unilaterally make this change.

CPA Canada also focused on three additional principles:

1. There can be no path to control (or veto) for one or two provinces

2. There must be a commitment to act nationally as a profession

We have agreed that provincial legislative mandates provide a basis for increased accountability of CPA Canada to the provincial, territorial and Bermudian partners. Concurrently, we asked for a commitment that all our CPA partner bodies act as a national profession.

3. CPA Canada’s role in the CPA ecosystem must be defined

We believe the role of CPA Canada, which is foundational to defining the goals of the national profession, must be determined by all provincial, territorial and Bermudian partners as part of a comprehensive governance agreement.

The Canadian CPA is the pre-eminent, globally respected business and accounting designation. We want to ensure Canadian CPAs continue to not only gain access to unparalleled professional resources and opportunities but also remain part of a thriving community of accounting professionals.

Through our national and international participation and influence, we can further enhance the reputation of, and trust in, the Canadian CPA designation, cementing Canadian CPAs as global leaders who are part of a vibrant national profession where members of the profession can thrive.

As we were not able to reach agreement on these principles, we started further conversations with all provincial, territorial, and Bermudian partners. Those discussions were ongoing when the withdrawal notices were sent.

The withdrawal notices mean that the other provincial, territorial and Bermudian partners remain in the accord and that all the other agreements continue. The terms of those agreements with the withdrawing parties are in the process of being finalized, starting with the education agreement, which will preserve the current education pathway for student. All parties have said they want to find a new way forward and we are wholeheartedly committed to that.

Our aim is for all CPA body partners to continue to work together.

In our roles as leaders of our respective bodies and representatives of our membership, we have a responsibility to act in the public interest. In this case, we strongly believe this requires us to do everything in our power to find a mutually beneficial resolution that addresses the concerns of all parties involved to ensure the CPA profession in Canada remains united in purpose and future-focused.

Q. WHY IS A NATIONAL CPA ORGANIZATION IMPORTANT?

CPA Canada represents the profession on the national and global stage.

Members of CPA Canada are part of a powerful collective voice that actively works to promote the profession's interests at both the national and international levels. CPA Canada's dedicated efforts shape public policy, influence regulatory frameworks and establish high professional standards that reflect the evolving needs of the accounting industry. By being a member, you directly contribute to these efforts, ensuring that your profession remains strong, trusted, respected and influential.

We ensure the Canadian CPA designation is globally recognized and respected for its rigorous educational requirements, comprehensive professional development and adherence to the highest ethical standards.

As countries around the world grapple with evolving financial reporting frameworks, our national voice positions Canada as a significant contributor to global standard setting. Together, we can influence the development of standards that align with our unique economic landscape, ensuring they strike a balance between transparency and practicality.

CPA Canada is a trusted advisor speaking for the profession in consultations with Finance Canada, the CRA, the Senate and other government bodies on important federal issues including the budget, tax regime and financial crimes.

By positioning ourselves as a cohesive force, we enhance our profession’s credibility and demonstrate our commitment to globally recognized standards of excellence. This, in turn, strengthens Canada's reputation as a trusted destination for investment and business.

Q: CAN YOU PROVIDE SOME CLARITY ON HOW THE WITHDRAWALS AFFECT THE MOBILITY OF OUR DESIGNATION, BOTH NATIONALLY AND INTERNATIONALLY?

Canadian CPAs will continue to enjoy interprovincial mobility –without extra examinations or obligations –because of our agreement to continue the national education program and other consistent requirements standardize the qualifications for practising the profession. This is a significant advantage when compared with other professions in Canada. We are confident that the new education agreement will uphold the cohesive national framework that is integral to ensuring the highest standards of integrity among students from coast to coast to coast.

However, the outlook for international mobility is less certain. CPA Canada negotiates international agreements on behalf of the regional partners. Going forward, the process for negotiations will have to be reconsidered.

CPA Canada acts as a strong, consistent and authoritative voice for the profession that elevates our leadership at the national and international levels. Our international partners have also indicated they wish to continue their engagement with CPA Canada as the national body given the advantages of consistency, efficiency, reputation, expertise, leadership, and mutual trust-building.

Q: IF THE WITHDRAWAL TAKES PLACE, DOES THIS MEAN CPAS IN THESE REGIONS WILL NO LONGER BE MEMBERS OF CPA CANADA? CAN WE CHOOSE TO BE A MEMBER OF CPA CANADA AND BOW OUT OF OUR PROVINCIAL ASSOCIATION?

At the end of the 18-month withdrawal period in December 2024, individual members of the withdrawing provinces will no longer be members of CPA Canada.

Granting designation for CPAs in Canada falls under the legislative authority and responsibility of the provincial bodies, and therefore all CPAs in Canada must be members through their provincial organizations.

Currently, CPA Canada membership is conditional on whether you’re a member in good standing with your provincial body, and your provincial body is an organizational member of CPA Canada.

As a result of the decision to withdraw, as it stands now, both CPA Ontario and Ordre des CPA du Québec will no longer be organizational members, which means you would no longer be a member of CPA Canada.

However, while the Collaboration Accord indicates that it is possible to withdraw, it doesn’t include any mechanism for doing so. Therefore, while we know the withdrawing provinces have signaled their intent, it remains to be determined what that means in reality as we move forward and find a new path together.

We are heartened by the intent that's been expressed by everyone in the profession to find a way forward.

However, intent doesn't create the agreements. We need to do the hard work in order to forge an agreement.

Members have expressed to individual board members and CPA Canada the value that they place on being a CPA Canada member. We recognize the importance to you. This is why we are working incredibly hard as a profession to resolve the challenges that exist.

Q: CPA ONTARIO HAS POINTED TO A LACK OF TRANSPARENCY ON CPA CANADA’S PART IN TERMS OF HOW IT SPENDS THE MEMBERSHIP DUES OF ONTARIO MEMBERS. WHAT IS YOUR POSITION ON THIS QUESTION?

We do not agree with the suggestion that CPA Canada is not transparent, accountable or responsive to feedback.

The provincial, territorial, and Bermudian bodies have more involvement than ever before.

We now provide quarterly operating reports and have revamped the way we report financials in our annual report to make them easier to follow.

After consulting with every provincial, territorial, and Bermudian body to hear their concerns and suggestions, we conducted an enterprise-wide reorganization last fall, resulting in a 10 per cent staff reduction, flatter structure, and changes in leadership to better orient us toward tomorrow’s challenges.

There has been unprecedented review by all provincial, territorial, and Bermudian bodies at a granular level of both our ongoing operations--where the money is spent --as well as the education budget that is funded separately by candidate courses and exam fees.

We are willing to work with our provincial, territorial and Bermudian partners on any further changes we can implement.

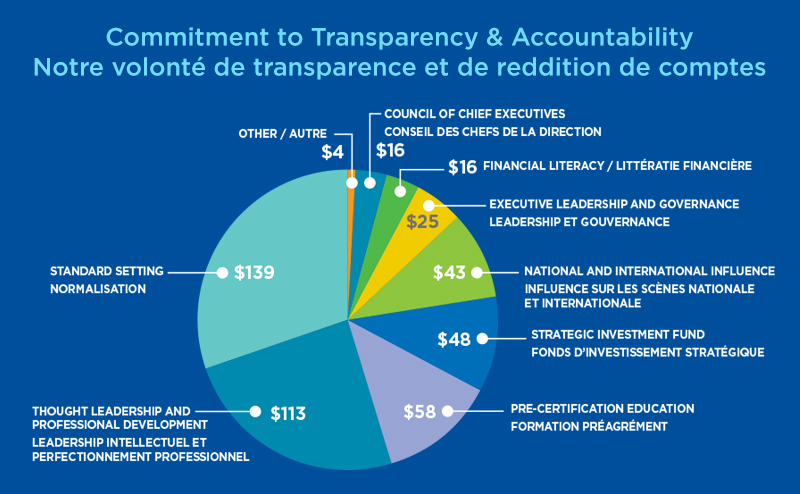

Here is a look at the breakdown of the $400 annual membership dues:

Q: CPA ONTARIO RAISED THREE CLAIMS WITH RESPECT TO CPA CANADA DURING THEIR ANNUAL GENERAL MEETING CENTRED AROUND THE TECHNOLOGICAL FAILURES EXPERIENCED DURING THE 2019 CFE; APPREHENSIONS REGARDING THE FINANCIAL TRANSPARENCY OF CPA CANADA'S EDUCATIONAL INITIATIVES; AND CPA CANADA’S DECISION TO REGISTER FOR A TRADEMARK. WHAT IS YOUR RESPONSE TO THESE CONCERNS?

CPA Canada has addressed all these past issues that were raised again at Ontario’s annual general meeting. To be clear, they were not included as reasons for withdrawal when CPA Canada was served notice in June. We remain focused on finding a way forward that enhances the reputation of the profession at the national and international levels in consultation with all the PTBs –including Ontario and Quebec –and all the CPA members of the Canadian profession.

2019 CFE

The 2019 CFE encountered technology failures that compromised the experience of those students who wrote the exam. It was the first time the profession collectively decided to move to a completely technological suite of solutions for the exams. Our top priority following this issue was to ensure we could evaluate the responses candidates had provided, which was a successful effort that involved a host of additional resources. At the conclusion of the marking process, the Board of Examiners (BOE) was confident that all students were treated fairly and that all passing candidates met the same entry requirement for the CPA profession. It was also noted that the pass rate for the September 2019 CFE was consistent with the pass rate in previous years.

An independent, third-party review was then conducted to help analyze the situation and summarize the lessons learned into a comprehensive report. This was executed by the then-just-retired Auditor General of B.C. Her report was completed in May 2020, which noted several recommendations that we implemented in time for the next September CFE.

Ontario and Quebec decided to conduct their own review, which was completed a few months later. The results of this review have never been released to the profession.

We are happy to report that since the profession’s implementation of reforms and improvements, including profession-supplied laptops for all exams, changes to the software, enhanced Wi-Fi, connectivity protocols and exam administration processes, there have been no other significant incidents with technology. CPA Canada remains committed to enhancing our testing protocols and software architecture through continuous work with our software supplier, establishing strict service level expectations.

Transparency on financial information, particularly educational initiatives

CPA Canada outright rejects the suggestions that we have not been transparent on educational initiatives. In fact, CPA Canada has never been more transparent, and we have been releasing a quarterly financial report to all our CPA body partners to be more accessible and aligned to the services we undertake as an organization. Our annual report to members has also been completely revamped to provide additional information to members about the services to which their fees flow.

The education budget, in particular, is extensively reviewed and approved by all of the education partners across the system in Canada, along with the Council of Chief Executives. Last year, in the budgeting process, we further enhanced that by including all of the PTB CFOs and CPA Canada’s CFO in a rigorous review process. We report quarterly on our progress relative to that budget, with results monitored on a regular basis. It is important to note that education costs have never exceeded the approved budget in any fiscal year, and CPA Canada is consistently responsive to all the PTBs and their requests.

We are pleased to have reached an agreement with Ontario and Quebec that recognizes CPA Canada’s pivotal role in education beyond 2024 and is rooted in our common belief that a cohesive educational framework is crucial for upholding the highest standards of integrity among students from coast to coast to coast.

Trademark

There is no issue around a trademark. CPA Canada always acts in the best interest of the public. The legislative roles of the provincial, territorial and Bermudian partners have never been in question. We believe that CPA Canada and the PTBs have vital roles to play in the enhancement of the profession, and we support strengthened oversight by our regional partners.

Q: CAN CPA CANADA CONVENE A FORUM FOR ONTARIO AND QUEBEC MEMBERS TO VOTE ON THE PROPOSED WITHDRAWAL AND GET OUR VOICES HEARD?

We know members want to have their voices heard. The proposed withdrawal of CPA Ontario and Ordre des CPA du Québec is a consequential decision and we agree that CPA members across Canada should be formally consulted. If members want to come together and create a forum to express their views to their respective provincial bodies, then we believe that is something they should undertake. CPA Canada encourages members to speak to their provincial bodies and ensure their voices have impact.

We want to assure that CPA Canada remains committed to listening to the views of our members and our provincial counterparts across the country and will incorporate them into our vision for the future of the profession.

Q: HOW WILL THE PROPOSED WITHDRAWAL OF ONTARIO AND QUEBEC IMPACT THE DUES OF THE REMAINING MEMBERS?

Both CPA Ontario and the Ordre des CPA du Québec have expressed their desire to continue funding standard setting in Canada, which comprises approximately a third of CPA Canada’s annual membership dues. The agreement on education also confirms their continued funding of a national, cohesive pre-certification education program for CPAs across the country.

CPA Canada has not raised a change to membership dues, and we would certainly not consider that without significant discussions and input from our PTB partners. Our top priority is to ensure we continue to provide high quality standards, guidance, support and thought leadership to both PTBs and our members.

Q: QUEBEC HAS A DIFFERENT LEGISLATIVE MANDATE THAN OTHER PROVINCES AND THEREFORE IT IS A UNIQUE PARTNER. HOW WOULD CPA CANADA RESPECT THAT?

CPA Canada recognizes and appreciates the concerns raised by the Ordre des CPA du Québec, and it is important to us that we have a partnership that respects the unique legislation in Quebec. We acknowledge the need to chart a new path forward that accounts for this, and we believe that is best achieved by continuing to work together in a way that respects the roles of both the provincial regulatory bodies and CPA Canada at the national and international levels.

CPAs agreed a decade ago that a strong, unified, national profession was in our best interest--and we believe it still is today. CPA Canada remains committed to constructive, consultative, transparent conversations that are focused on finding the best outcome for our profession.

Q: HOW DOES THE OVERSIGHT OF CPA CANADA WORK?

Currently, CPA Canada’s board of directors is composed of 12 directors, eight of whom are nominated by the regions.

In order to address size differences across Canada, representation is distributed as follows:

- Ontario and Quebec each have two board directors.

- Alberta and B.C. each have one director.

- Saskatchewan and Manitoba share one director appointment.

- The Atlantic provinces together with Bermuda, appoint one director.

The remaining four members of the board are selected by the board. Two are public directors selected through an application process. The final two directors are the chair and the vice chair, who are members of CPA Canada.

Q: IS IT POSSIBLE FOR CPA ONTARIO AND THE ORDRE DES CPA DU QUÉBEC TO REMAIN PART OF CPA CANADA, OR IS THEIR DEPARTURE A FAIT ACCOMPLI?

The withdrawal notices from CPA Ontario and the Ordre des CPA du Québec have brought a certain definitiveness to the current situation in that those provincial bodies have indicated their intention to leave CPA Canada.

We must act responsibly and continue to look at what shape the future might take in the absence of those provincial bodies.

At the same time, all parties have said they would like for us to continue to work together.

Therefore, in our discussions, which are ongoing, we are doing our utmost to find alternative ways to work together in a way that respects the roles of both the provincial regulatory bodies and CPA Canada at the national and international levels. The key is that we continue to act nationally together so that we retain all of the benefits that we have achieved since unification ten years ago.

Q: HOW CAN WE HAVE CONFIDENCE THAT THIS CONTROVERSY WILL BE RESOLVED, GIVEN THAT THE ISSUES AT HAND HAVE BEEN DISCUSSED AND REMAINED UNRESOLVED FOR YEARS?

Like CPA Canada, there are many organizations in Canada, whether not-for-profit, professional or governmental, that have national and provincial dimensions. And as members of those organizations have told us, they, too, experience the kinds of tensions that come from having such structure. That is how Canada works and Canada works very well.

We are confident that through continued discussions we will be able to find a path forward that is in the best interests of members and the public.

Q: HAVE ANY OF THE OTHER PROVINCIAL, TERRITORIAL AND BERMUDIAN BODIES INDICATED THEIR INTENT TO LEAVE THE COLLABORATION ACCORD IF NO PATH FORWARD IS FOUND?

No, not at all. The Collaboration Accord will carry on with the remaining provincial, territorial and Bermudian bodies and we look forward to working together to tackle the important tasks and challenges that face the profession while embracing the many opportunities that lie before us.

Q: WHAT IS THE CONNECTION BETWEEN CPA CANADA AND STANDARD SETTING IN CANADA? WOULD THIS BE AFFECTED IF CPA ONTARIO AND THE ORDRE DES CPA DU QUÉBEC WERE TO WITHDRAW?

CPA Canada supports and stewards an independent, efficient and effective standard-setting system through its vital relationship with Financial Reporting and Assurance Standards Canada. This relationship is evolving but CPA Canada’s fundamental commitment to an independent, internationally recognized standard-setting system is unwavering.

In March 2023, the Independent Review Committee on Standard Setting in Canada (IRCSS) released its final report to identify future needs for standard setting in Canada. It highlights the need to ensure that the benefits of the existing framework between CPA Canada and standard setting are preserved, while also emphasizing the importance of independence.

The IRCSS suggested the creation of a separate legal entity with a new diversified funding model that includes CPA Canada and additional sources of funding.

The IRCSS recommendations are moving forward and implementation plans are underway.

Highlights of the changes include:

- An independent, not-for-profit standard-setting entity, expected to be established in 2024.

- A diversified, national funding model that includes a new agreement with the current funder, CPA Canada, to ensure its long-term support. The model will be user-agnostic and funders will not have any governance rights.

- A single oversight council to oversee standard setting for sustainability, accounting and audit and assurance.

- A new agreement with CPA Canada for the supply of services in areas such as information technology, finance, translation and human resources.

- Contractual arrangements that provide rigorous safeguards to preserve independence for staff seconded from CPA Canada.

- The inclusion of a clause in a new agreement to preserve and reinforce CPA Canada’s stewardship responsibilities with respect to any proposed fundamental changes to the standard-setting structure.

- Intellectual property relating to standard setting will continue to be owned by CPA Canada. Access to final standards will continue to be provided via the CPA Canada handbook, but at no charge to the public.

- Other materials in the CPA Canada Handbook, such as non-authoritative guidance will continue to be restricted to CPA Canada members and other paying subscribers.

Read more about all 26 IRCSS recommendations and their approved next steps.

Q. DOES CPA CANADA SEE A PATH FORWARD FOR A UNIFIED PROFESSION?

We remain committed to constructive dialogue with all of our provincial, territorial and Bermudian partners in the interest of finding a mutually beneficial resolution that respects the legislative authority of the provincial regulatory bodies and the role of CPA Canada at the national and international levels.

Stay informed and help inform our next steps!

We value your input as we work toward a future model that best serves the interests of Canadian CPAs. Sign up to receive updates and opportunities to engage with us.