Shock then pride: How 3 CFE writers reacted to winning regional honours

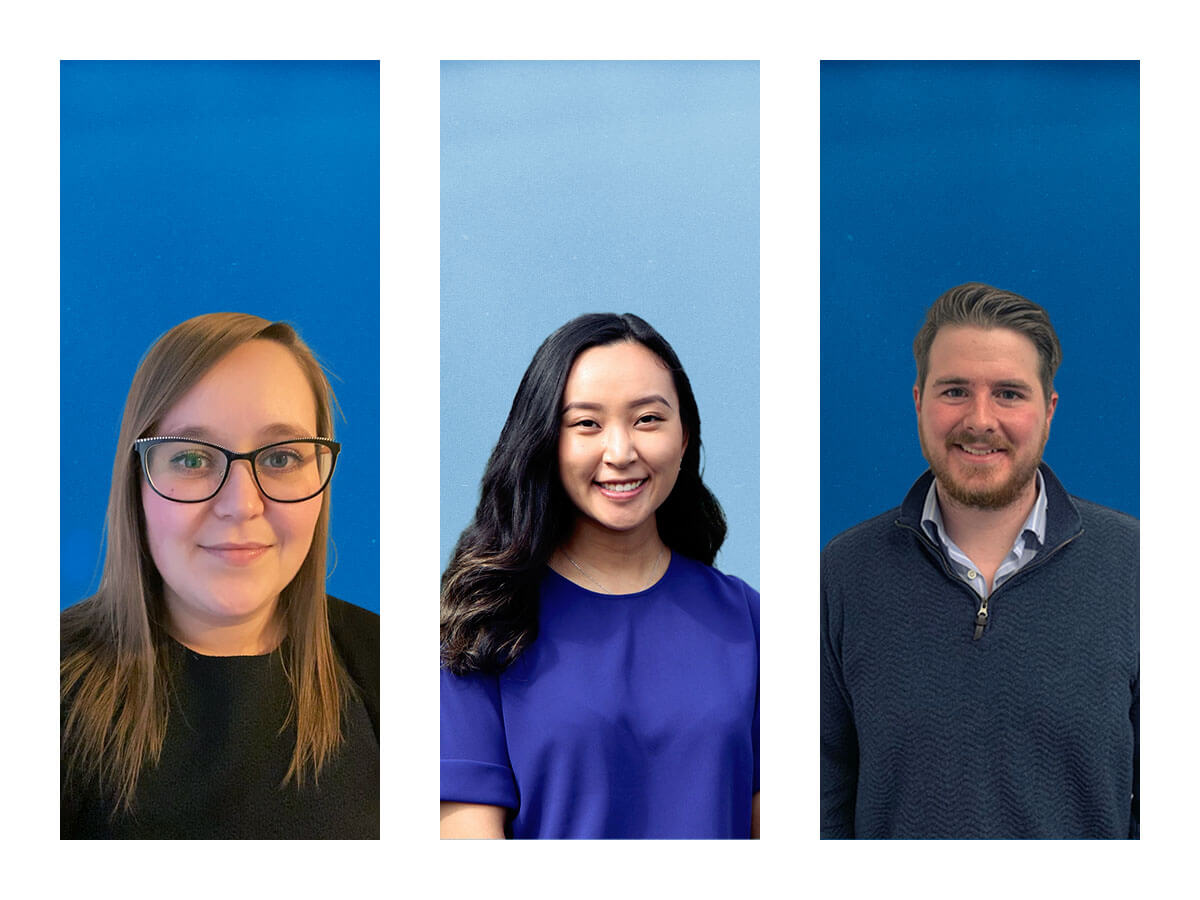

From left to right: Stacey Bailey, Sarah Wang and André Caissie (Images provided)

From left to right: Stacey Bailey, Sarah Wang and André Caissie (Images provided)

A big congratulations to the 5,912 writers who passed September’s sitting of the Common Final Examination (CFE). The dedication and hard work of each person who wrote the three-day exam—each in their own hotel room, to adhere to public health protocols—can be seen in the successful results.

Along with $5,000 to the overall top writer, Chloé Bourgault-Bourassa of Quebec, CPA Canada awarded a $2,500 cash prize to the regional winners who received the top marks.

Stacey Bailey from Morgan & Associates in St. John’s, NL is the Atlantic Canada winner; André Caissie from Deloitte LLP in Ottawa is the Ontario winner; and Sarah Wang from Deloitte LLP in Vancouver is the Western Canada winner.

We spoke to the three regional winners about their experience preparing for the exam and what inspired them on their journey towards becoming a CPA.

CPA CANADA: WHAT DOES BEING NAMED AS THE REGIONAL WINNER MEAN TO YOU?

Stacey Bailey (SB): It’s a huge accomplishment for me that I’m really proud of. It feels amazing to have all my hard work pay off in such a big way.

André Caissie (AC): It makes me really thankful for everyone who has supported me over the past few years, including my teachers and various co-workers.

Sarah Wang (SW): It feels a little unreal. But I’m super proud. It feels like it’s a great achievement for not just me, but also for my firm.

CPA CANADA: WHAT WAS YOUR REACTION WHEN YOU GOT THE NEWS?

SB: I was shocked but elated to hear I’d done so well. Finding out that I had passed after three long months of waiting was mostly a relief, but this news really made it exciting for me.

AC: I was in shock at first. I had to ask a few times, “Are you sure it’s not just the honour roll?” But [the partner] confirmed that I had won the regional gold medal.

SW: It just didn’t feel real, even after the call. For a moment I was thinking ‘Wait, did I hear him wrong?’ I still didn’t believe it.

CPA CANADA: WHAT ADVICE WOULD YOU GIVE THOSE PREPARING TO WRITE THE CFE?

SB: I would suggest thinking about what study habits and methods have best suited you in the past and modify as needed. Don’t be influenced by what others are doing! I would also recommend following a schedule, so you don’t get too overwhelmed.

AC: My biggest advice would be to focus on your mindset, especially in the period leading up to the exam.

SW: When you’re writing practice cases, do it under exam-like conditions, under a time constraint and with one laptop and only the equipment you would have in an exam. Also, remember to take days off and don’t overwork.

CPA CANADA: WHO OR WHAT INSPIRED YOU TO PURSUE THE CPA DESIGNATION?

SB: I completed my undergrad in applied math but had no idea what I wanted to do after graduation. During my degree, I took a few accounting courses out of interest. The love of numbers and problem solving that led me toward a math degree translated really well into accounting, so it was a good fit.

AC: I would attribute it to my different teachers and colleagues I’ve had at work. I met a lot of intelligent people and they all stressed the importance of the CPA designation. So, that was the biggest motivator.

SW: I was inspired to pursue the CPA designation starting in my first year of university. What really drew me was hearing senior classmates talk about how the designation opens your eyes to different areas of the business. I wanted to see the big picture rather than just focus on a small section of the business.

CPA CANADA: HOW HAS THE CPA PROGRAM HELPED TO DEVELOP YOUR PROFESSIONAL SKILLS AND COMPETENCIES?

SB: I've gained a lot of confidence in my skills and competencies throughout the program. The modules were progressively more challenging, allowing me to take skills learned from one and apply them to the next so that I was constantly improving.

AC: Often in life the answer is not clear—there’s some sort of ambiguity, and the CPA program really taught me how to approach those situations and problems and how to solve them.

SW: With the technical competencies, I’m able to understand when people talk about their tax problems, etc. But it’s the enabling competencies that the profession really puts an emphasis on. Those helped me be more reflective of my actions. For example, when I’m leading a junior [colleague], I reflect on whether I’m being a good leader. Am I demonstrating good communication in my meetings or in my email to clients?

CPA CANADA: WHAT HAVE YOU LEARNED OR DISCOVERED ABOUT YOURSELF WHILE PURSUING THE CPA DESIGNATION?

SB: My ability to overcome challenges is a lot better than I give myself credit for. I always thought I would quit before I made it to the CFE. It’s hard to balance demanding courses, a full-time job and your personal life. It’s been a lot of hard work and perseverance but I’m happy to have stuck with it and succeeded.

AC: I realized that I would perform a lot better if I learned to accept mistakes and not be hard on myself in terms of adhering to a strict schedule. It’s far more important to approach any challenge with a positive attitude and a clear mindset.

SW: Pursuing a CPA is much more than just your accounting courses. It’s a lot about problem solving. For example, the knowledge I’ve learned through my CPA modules has enabled me to help my mom, a small business owner, through her business issues. It’s been great to be able to leverage that knowledge.

CPA CANADA: WHAT ARE YOUR CAREER GOALS AS A CPA?

SB: Up until now I could never see past the CFE, so I don’t currently have any career goals. I like the variety I’ve been able to experience to this point. I’m looking forward to the future and keeping an open mind.

AC: I’m really happy where I am right now. For me, the most important thing is just to be in an environment that continues to allow me to be exposed to complex challenges. For example, I’ve had the opportunity to work on structuring complex tax transactions and that is something I look forward to continuing to do [as a] CPA.

SW: It’s always been a goal of mine to eventually go into teaching, whether that’s accounting in university or college, teaching CPA professional development courses or basic accounting. I would also like to help small businesses with either their accounting, tax or their business problems. It all ties into feeling like there are so many opportunities that I can pursue and offer to the world as a CPA that’s beyond working in an office.

CHECK OUT THE 2021 CFE HONOUR ROLL

See the full list of honour roll candidates. Plus, read about how the Governor General’s Gold Medal winner landed the top spot.