New Details on the Canada Emergency Wage Subsidy

On March 27, 2020, the federal government announced that the new CEWS would deliver a 75 per cent wage subsidy to eligible employers for up to 12 weeks, retroactive to March 15, 2020.

A backgrounder released by the Department of Finance Canada on April 1, 2020 provided more details on how the subsidy will work. While helpful, the details raised concerns that the subsidy would leave out many businesses that should qualify.

Both CPA Canada and the Canadian Tax Foundation received feedback from many members and stakeholders on the CEWS. We compiled the key questions and issues we were hearing in a summary which we presented to the federal government.

On April 8, 2020, the Department of Finance Canada released a second backgrounder that refined the CEWS rules and clarified how the subsidy would apply. Finally, on April 11, 2020, the federal government enacted Bill C-14 providing greater clarity on how the subsidy will work. Along with this, Finance Canada updated the April 8th backgrounder to reflect the final legislation on the CEWS.

In this article, we summarize the rules and highlight the issues that remain outstanding. Please refer to the legislation for further details. (Please note that any reference to “backgrounder” in the balance of this blog is in reference to the April 11th backgrounder.)

How it works

The CEWS will be generally available to all eligible employers and will amount to 75 percent of the total “eligible remuneration” paid during the “eligible period.”

Which employers are eligible?

Eligible employers, referred to in the legislation as eligible entities, include individuals, taxable corporations, partnerships consisting of eligible entities, non-profit organizations (NPOs), and registered charities. The final legislation clarifies that beyond NPOs, eligible entities would also include other entities exempt from Part I tax such as unions. Employers of all sizes and across all sectors qualify, except public bodies.

This definition is broader than the one for the Temporary Wage Subsidy (TWS) (discussed in our earlier Tax Blog). However, as we note in our summary of issues, it seems that some employers will still be missed.

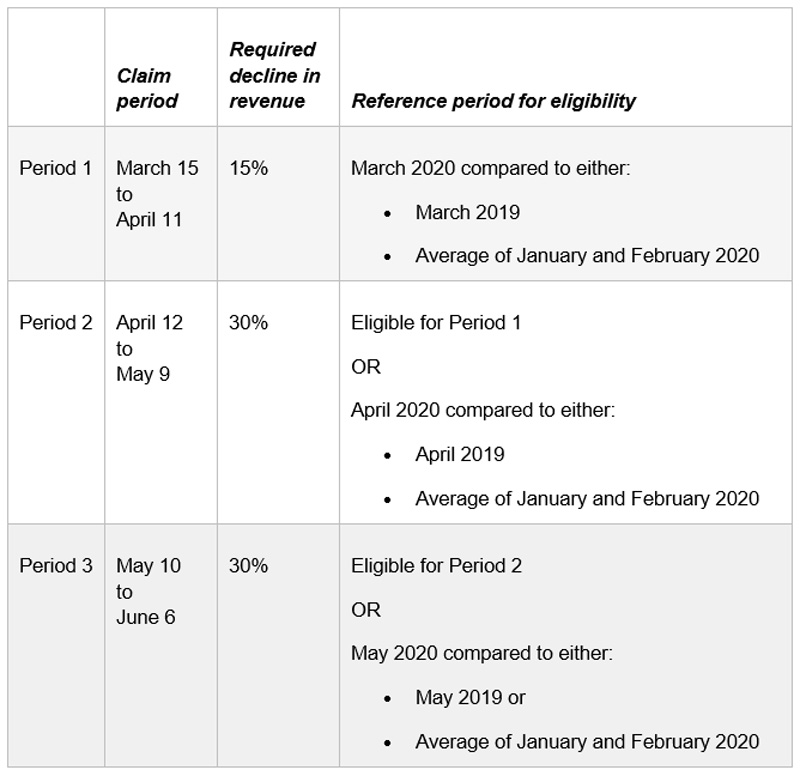

To qualify for the subsidy, eligible entities must see a decline in revenues of at least 15 per cent in March 2020, and at least 30 per cent in April 2020 and May 2020.

This revenue test is a welcome change from the one set out in the April 1 backgrounder. The earlier test required a 30 per cent drop in revenues for March 2020, which was inappropriate because the pandemic’s impact did not begin to significantly affect businesses until the middle of that month.

What is the revenue test?

An employer’s revenue for the subsidy includes its revenue earned in Canada from arm’s length sources, calculated using the employer’s normal accounting method. Employers can choose to compute their revenues using either the accrual method or cash method of accounting but not the two methods combined. Employers must use the method they select when they first apply for the CEWS for the duration of the program.

The government also provided clarity for charities and NPOs by allowing them to include or exclude revenue from government funding in their computation. Once the charity or NPO has chosen, they must continue with the same approach for the entire program.

Employers can use one of two benchmarks for the revenue test. They can choose to compare their revenue of March, April, and May 2020 to either:

- The same months in 2019

- An average of their revenue in January and February of 2020

The second option was introduced to address feedback from employers, such as start-ups and high-growth companies, and not-for-profits, who were concerned that a strictly year-over-year approach would produce unfair results. Again, once an employer has selected the benchmark they want to use, they must use it for the program’s duration. The revised rule will also adjust revenue for January and February 2020 for start-ups during this period.

Finally, when measuring the revenue loss, the CEWS amount received by the eligible entity in a month is excluded.

Many businesses have complex business arrangements where the method of revenue recognition is not straightforward. Using revenue per month as a yardstick may not accurately capture a severe downturn in business. The ability to use either the accrual method or the cash method for the revenue test, as described above, is a partial remedy.

To provide greater certainty and simplicity to employers, once an employer is found to be eligible for a specific period, the employer will automatically qualify for the next period. This will also allow the entity to recover during the next period without losing the subsidy. This was a change from the initial proposals in that employers were originally being asked to apply for the subsidy each period.

The Department of Finance Canada’s table, reproduced below, shows the remuneration claiming periods, the required reduction in revenue for that period, and the reference period for determining whether the revenue test is met.

Credit Source: Finance Canada

Revenue test for corporate groups

The original announcement of the CEWS restricted the revenue test to arm’s length revenue. This would have caused issues for businesses with significant revenue from inter-entity transactions. The legislation allows potential relief in two ways.

First, the legislation allows a group of affiliated entities to calculate consolidated revenue and then each eligible entity in the group can use the consolidated amounts for the purposes of the revenue test. Although a decline in revenue will be measured for the group as a whole, it does help to eliminate issues where revenue generation and payroll functions do not coordinate properly.

Second, the legislation provides a special rule where all or substantially all of an eligible entity’s qualifying revenue is from other non-arm’s length entities. In these situations, the rule generally allows the entity to determine its decline in revenue based on the decline in arm’s length revenue experienced by non-arm’s entities from which it earned revenue.

For example, if a manufacturing company sells all of its output to a related company, Company X, and Company X in turn sells to arm’s length parties, the manufacturing company would be able to determine its revenue decline based on the decline in arm’s length sales experienced by Company X.

How much is the subsidy for arm’s length employees?

The subsidy is designed to encourage eligible entities to pay employees at least 75 per cent of their pre-crisis wages because they can recover it through the subsidy.

The amount of the subsidy for an eligible employee on eligible remuneration paid between March 15 and June 6, 2020 is the greater of:

- 75 per cent of the amount of remuneration paid, up to a maximum benefit of $847 per week; and

- the amount of remuneration paid, up to a maximum benefit of $847 per week or 75 per cent of the employee’s baseline remuneration, whichever is less.

“Eligible remuneration” includes salary, wages and other remuneration like taxable benefits paid to an eligible employee. It does not include items like severance pay or stock options benefits. How irregular payments, such as bonuses or commissions, will be adjusted for is still unclear. In addition, it should be noted that the rules limit the subsidy that may be claimed where an individual is employed by multiple non-arm’s length employers.

An “eligible employee” is generally an individual employed in Canada. Note that employees who are without remuneration for a two-week period during the qualification period are excluded.

“Baseline remuneration” is essentially the employee’s pre-crisis remuneration and is the average weekly remuneration paid to the employee between January 1 and March 15, excluding any seven-day periods for which the employee was not paid.

There is no cap on the amount of CEWS an employer can claim. The government has asked employers to do their best to top up employee’s salaries and bring them to pre-crisis wage levels. No guidance has been provided at this time on how the government will measure best efforts or what the consequences would be for those who don’t make them.

Non-arm’s length employees

For employees that do not deal with the employer at arm’s length, the rules limit the subsidy to the eligible remuneration paid in any pay period between March 15 and June 6, 2020 to the least of:

- $847 per week

- 75 percent of the employee’s baseline remuneration

- The amount of eligible remuneration paid to the eligible employee for that week

The subsidy is only available to non-arm’s length employees employed before March 15, 2020. An employer cannot be subsidized for remuneration paid to non-arm’s length employees hired after the crisis began. The computation for non-arm’s length employees appears to adversely affect them if they received dividends as remuneration during the baseline period (i.e. January 1 to March 15, 2020) or no remuneration at all.

Refunds of payroll contributions

A new feature is a 100 per cent refund for eligible employees for certain contributions paid to Employment Insurance, the Canada Pension Plan, the Quebec Pension Plan and the Quebec Parental Insurance Plan for employees who are on paid leave.

Employers should continue to collect and remit employer and employee contributions to each program as usual and apply for the refund when they apply for the CEWS. Although the government suggested this measure would help employers bring laid-off employees back to paid-leave status, this measure does not seem to be restricted to these employees.

Compliance and penalties

Eligible entities can apply for the CEWS through the Canada Revenue Agency’s My Business Account portal or a web-based application in development. Employers should keep records to verify the decline in revenues and the remuneration paid to employees. Employers that do not meet the eligibility requirements would have to repay amounts received under the CEWS.

Since the subsidy is government assistance, it will be taxable. The government says more details on compliance requirements will come shortly.

To preserve the program’s integrity, the penalties for fraudulent claims are severe and will include fines and possible imprisonment. Artificial transactions to reduce revenue for the purpose of claiming the CEWS would be subject to a penalty equal to 25 percent of the value of the subsidy claimed, in addition to the requirement to repay the full subsidy that was inappropriately claimed. The legislation also includes anti-avoidance rules that prevent manipulation of the CEWS computation.

Note that an individual who has principal responsibility for the financial activities of the eligible entity must attest that the application is complete and accurate in all material respects.

Finally, the legislation allows for the Minister of National Revenue to publicly communicate the names of any employer who applies for the CEWS.

Interaction with the other programs

With the original 10 per cent Temporary Wage Subsidy still available, it’s important for employers to determine which program applies.

Employers who meet the CEWS revenue test for the CEWS can also claim the TWS but, according to the backgrounder, any benefit from the TWS “would generally reduce the amount available to be claimed under the CEWS.”

Similarly, any EI benefits received by employees through the Work-Sharing program will reduce the benefit that their employer is entitled to receive under the CEWS.

Employers who are ineligible for the CEWS can claim the TWS, as long as they meet the conditions for that program, which have not changed.

While the federal government has dealt with many of the issues with the CEWS that we raised in our summary, some issues are still unresolved. We hope the remaining concerns on our issues list will be considered further, and we will continue to follow up with the government as it works to implement the program.

Finally, we are also encouraging the CRA to deliver clear guidance on who is eligible for the CEWS, how to apply, and what documentation and evidence are required to support claims so that employers can have as much certainty as possible.

NOTE: The commentary function of this page has been temporarily closed. Unfortunately, because of the volume of feedback regarding recently announced COVID-19 tax measures, we do not have the capacity to respond to individual inquiries. We strongly encourage you to visit our Federal Government COVID-19 Tax Updates page for information.