COVID-19 tax update: Deadlines, international issues and wage subsidies

Below, we deliver the latest news on:

- new extensions for income tax filings and payments

- new guidance on international tax issues resulting from travel restrictions

- changes to the CRA’s administration of cross-border tax matters, such as processing waivers and section 116 certificates

- simplifications to the process for claiming the Temporary Wage Subsidy and Canada Emergency Wage Subsidy

- the CRA’s special process for requesting clearance certificates

CRA UPDATES INCOME TAX FILING AND PAYMENT DEADLINES

We continue to raise the urgent need to extend personal and corporate tax deadlines and provide relief for late-filing penalties, and the CRA has taken some action accordingly.

- T1 returns: On May 22, 2020, the CRA announced relief for late-filing and other penalties and interest for 2019 personal returns filed after June 1.

- T2 and T3 returns: On May 25, the CRA announced deadline extensions for corporate and trust income tax returns otherwise due in June, July and August.

- Other filings and information requests: Extensions were also announced for other information returns, elections, designations, and information requests due in June, July or August.

Note that no changes were made to the payment extension to September 1, 2020, as previously announced.

Details about these extensions are as follows.

Interest and penalty relief for late-filed T1s

Although the CRA did not further extend the deadline for 2019 T1 returns, they won’t charge penalties or interest for returns not filed by the regular due date. The CRA’s May 22 release says: “Penalties and interest will not be charged if payments are made by the extended deadlines of September 1, 2020. This includes the late-filing penalty as long as the return is filed by September 1, 2020.”

This relief is also allowed for:

- 2019 T1 returns due on June 15, 2020 for self-employed taxpayers and their spouses

- 2019 T1 returns for deceased individuals otherwise due from June 1 to August 31

- T1135 forms and other elections, forms and schedules that must be filed with the return, as long as they are filed by September 1, 2020

We have asked the CRA to answer these outstanding questions:

- How would the CRA assess a T1 that is filed by September 1 if the tax is not paid by then?

- If a return is filed by September 1 but the CRA makes an adjustment to the return after September 1, 2020 resulting in more tax, how would interest and penalties apply to the additional tax assessed?

- Has the CRA adjusted their IT systems to ensure interest and penalties will not be assessed?

Filing due dates for corporate tax returns

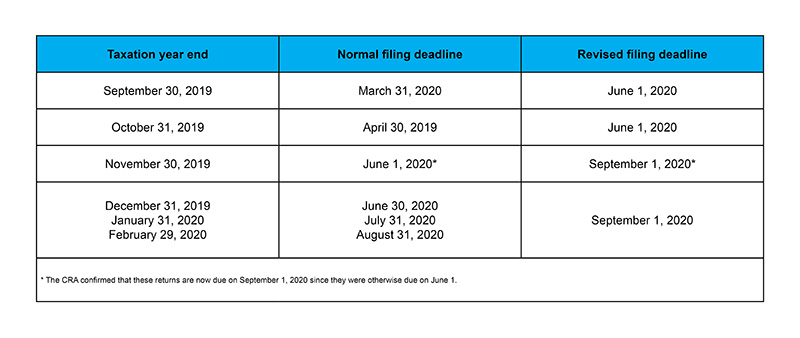

The CRA stated that all T2 corporate income tax returns “otherwise due” in June, July or August 2020, are now due on September 1, 2020. The extension applies to T106 and T1135 forms, as well as any elections, forms and schedules that are filed with corporate returns.

This announcement caused uncertainty for returns due on June 1 under the previous extension announced in March. The CRA has now confirmed with us that such returns covered by the previous extension are still due on June 1.

The application of the extension for corporations with November 30, 2019 year-ends was also unclear. These returns are due on June 1 because May 31, 2020 falls on a Sunday. The CRA has confirmed with us that these returns are now due on September 1, 2020 since they were otherwise due on June 1.

What these announcements mean for various year-ends can be confusing. The chart below summarizes the impact of these extensions.

Filing due dates for trust tax returns

Deadlines for 2020 T3 trust returns are similarly extended:

- T3 returns otherwise due on March 31, 2020 or during April or May 2020, are due on June 1, 2020, as announced in March.

- T3 returns otherwise due in June, July or August 2020, are now due on September 1, 2020.

Late-filing penalties and interest will be waived for T1135 forms and any other elections, forms and schedules that must be filed with the T3 return, as long as they are filed by September 1, 2020.

Deadlines for other forms and returns

The CRA also extended deadlines for other information returns, elections, designations, and information requests due in June, July and August, to September 1, 2020. Again, this excludes filings and requests due on June 1, 2020 because of the March extension, and the CRA did confirm this with us.

Partnership returns normally due on May 31, 2020, which is a Sunday, are otherwise due on June 1 this year. The CRA confirmed with us that these returns are now due by September 1, 2020.

Finally, we note that the CRA did not extend filing deadlines for Form T661 forms for Scientific Research and Experimental Development claims. As you may know, the federal government released draft legislation to allow the CRA to accept late-filed Form T661s, but the CRA has not yet communicated how they intend to apply this legislation.

CRA GUIDANCE ON INTERNATIONAL TAX ISSUES

Among measures to contain COVID-19’s spread and protect their citizens’ health, governments around the world have imposed travel restrictions. For the many stranded cross-border workers and others unable able to travel as planned, these restrictions are creating Canadian income tax issues.

Below we summarize some highlights from recent CRA guidance on cross-border tax issues. Related tax administration issues are discussed further below. The CRA has indicated the guidance applies only from March 16 to June 29, 2020. The CRA may extend these measures beyond then if necessary. Many of these items are subject to conditions, so be sure to review the CRA guidance in detail.

Individual income tax residency

Employees visiting Canada who can’t get back to their country of residency due to the travel restrictions should not in itself cause the common-law factual residency test to be met. Their number of days spent in Canada will not count toward the 183-day deemed residency test.

Corporate income tax residency

Foreign-resident corporations with one or more Canadian board members who cannot physically attend meetings outside Canada should look to the relevant treaty tie-breaker rules. The CRA indicates these rules should resolve most residency issues. In particular, the CRA states that where travel restrictions force a company director to take part in a board meeting in Canada, the CRA would not consider the corporation to be tax-resident in Canada solely for that reason. When dealing with non-treaty countries, the CRA will evaluate whether Canada’s central mind and management tax residency test is met on a case-by-case basis.

Carrying on business in Canada and permanent establishments

Where a non-resident business has employees who must work in Canada due to travel restrictions, this should not by itself affect whether the employer is viewed as carrying on business in Canada. This should also not affect whether the arrangement meets a tax treaty’s criteria that establish when agents or services give rise to a permanent establishment.

Cross-border employment income

The CRA says that the number of days that a non-resident employee works in Canada because of the travel restrictions do not count toward the relevant treaties’ days of presence test. Similarly, non-resident employers that employ Canadian tax residents who now work in Canada because of travel restrictions and have a letter of authority in place for the period in question, the non-resident employer’s withholding obligations will not change in Canada.

Finally, the guidance includes a special email address for taxpayers to send residency and permanent establishment questions related to the COVID-19 travel restrictions.

CRA’S INTERNATIONAL TAX ADMINISTRATION – WAIVERS AND 116 CERTIFICATES

The pandemic has affected many of the administrative functions the CRA typically performs related to cross-border tax matters, such as processing waivers and section 116 certificates. The CRA has updated their website to provide guidance on some administrative matters as follows:

Regulation 102 and 105 waivers

During the COVID-19 period, urgent requests to waive withholdings under Regulations 102 and 105 can be submitted electronically, and the CRA now provides a special email address and fax number for these requests. Where a non-resident submitted a waiver request but the CRA did not process it within the required 30 days because of COVID-19, the CRA will not assess penalties and interest for failing to withhold. The CRA indicates that these non-residents would have taken reasonable steps to determine that a relevant tax treaty qualifies them to reduce or eliminate the withholdings.

Section 116 certificates

Where the CRA has not processed a non-resident vendor’s Section 116 certificate request by the time the purchaser’s remittance is due, the vendor can obtain a comfort letter from the CRA advising the parties involved to retain the withheld funds. If the taxes are later remitted at the CRA’s request, no penalties and interest will be assessed.

In addition to this guidance, the CRA indicates that restrictions on their mail operations may prevent them from accessing any documents sent to them after March 12, 2020. Processing of requests sent before then may also be delayed. The CRA has set up temporary procedures that allow taxpayers and their representatives to electronically submit urgent requests for:

- International waivers (Regulation 105, 102 and RC473 waivers)

- Section 116 compliance certificates (T2062, T2062A, T2062B, T2062C forms)

Finally, the CRA will not process Form 1261 for requesting an individual tax number alongside waiver applications. These requests must still be mailed per the form’s instructions.

STREAMLINED PROCESS FOR WAGE SUBSIDIES

The CRA is streamlining its processes for claims for the Temporary Wage Subsidy (TWS) and Canada Emergency Wage Subsidy (CEWS).

As you may recall, the TWS works by deeming eligible employers to have over-remitted their employee income tax source deductions for the TWS they are eligible for. Employers claim the TWS by simply reducing their source deductions by the deemed over-remittance. Employers also eligible for the CEWS would then reduce their CEWS claim by the total of all TWS amounts they are eligible for (whether claimed or not). They would report this amount on line F of the CEWS application form.

This process created extra work when employers are eligible for both the TWS and the CEWS. We asked the CRA to simplify the process in situations where the TWS claim simply reduces the CEWS amount. We were also concerned that some employers would assume that they could not claim the TWS amount and enter “0” on line F.

Two recent announcements ease the process. First, TWS regulations released on May 15 indicate that the TWS is computed at 10 per cent of remuneration paid or at a lower percentage elected by the eligible employer. This allows an employer to essentially choose to not claim the TWS by electing a TWS percentage of 0 per cent.

Recent updates to the CRA’s Frequently Asked Questions on CEWS and TWS advise employers how to make the election. The CRA indicates that if an employer completes the CEWS application and does not enter an amount on line F for the TWS, the CEWS will be determined as though the employer had elected a TWS rate of 0 per cent and is thus claiming the maximum CEWS. The CRA’s FAQ also instructs employers to indicate the 0 per cent election on the “self-identification form under the 10% temporary wage subsidy program.”

The self-identification form is not yet available. When ready, the CRA will post it on their TWS FAQ page.

This relief is welcome but note that only the CEWS and TWS FAQ pages have been updated. The CRA’s instructions on the CEWS application form do not yet reflect this change.

PROCESSING CONTINUES FOR CLEARANCE CERTIFICATES

The CRA has updated their COVID-19 webpage to say they continue to process clearance certificates (Forms TX19 and GST352) but processing times may be longer given the current situation and the CRA’s limited resources.

The CRA has set up special procedures to allow taxpayers and their representatives to submit clearance certificate requests and supporting information via email.

We expect more details and announcements on COVID-19 tax measures in the coming weeks.

NOTE: The commentary function of this page has been temporarily closed. Unfortunately, because of the volume of feedback regarding recently announced COVID-19 tax measures, we do not have the capacity to respond to individual inquiries. We strongly encourage you to visit our Federal Government COVID-19 Tax Updates page for information.