The DIY furniture company coming after IKEA

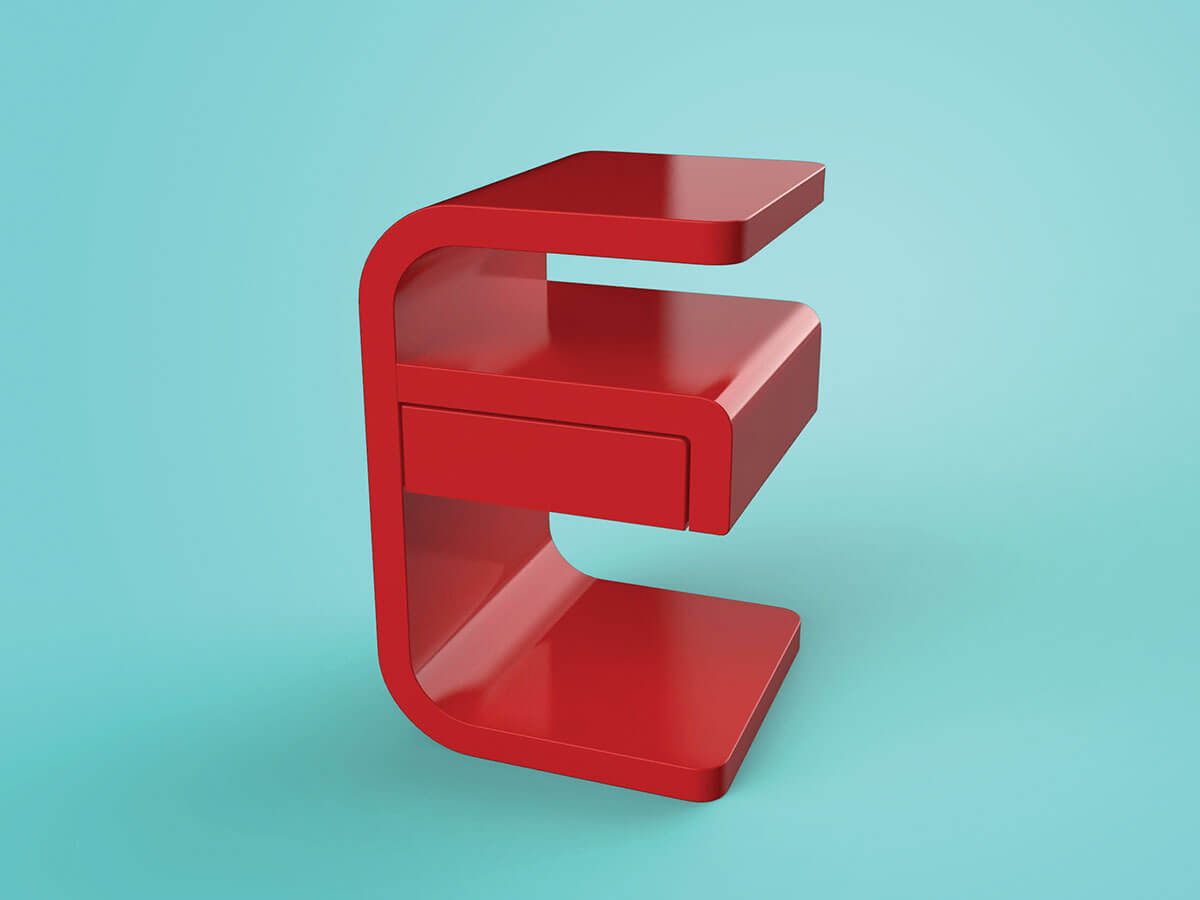

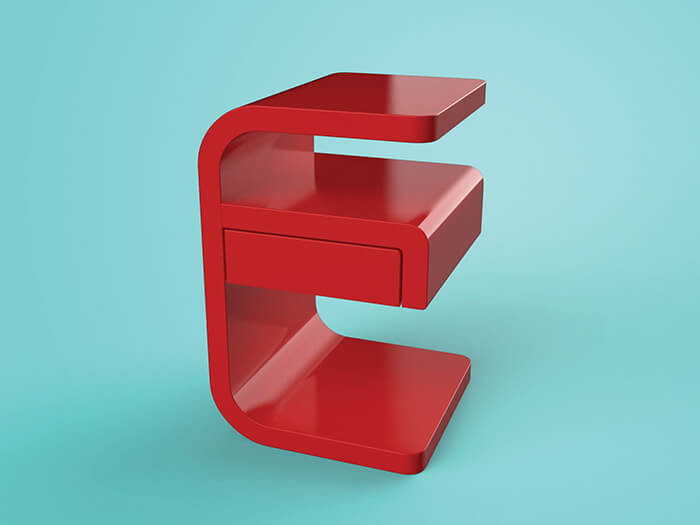

Naya allows users to develop their ideas while also providing connections to local manufacturers who can turn the concepts into reality (Photograph courtesy of Naya)

Naya allows users to develop their ideas while also providing connections to local manufacturers who can turn the concepts into reality (Photograph courtesy of Naya)

After mastering all the trendy pandemic lockdown hobbies—baking sourdough, birding, cycling the Tour de France on a stationary bike—what else is there? Perhaps DIY furniture design. While completing a masters degree in design engineering at Harvard University in 2019, Calgary’s Saad Rajan developed a web-based platform for exactly that. Called Naya, it allows anyone, including amateur design lovers and actual architects, to develop their ideas while also providing connections to local manufacturers who can turn the concepts into reality. “It’s more than a matchmaking service for craftspeople and clients,” says Rajan, referencing Naya’s built-in tools to help cost out the furniture. “It’s an end-to-end solution to facilitate the whole design and creation process,” he says.

Beyond being a COVID-era diversion, Naya, which makes money by charging a transaction fee, has tough competition in becoming a furniture-production mainstay. Canadian homes are mainly kitted out by two huge, low-cost purveyors, Leon’s (which also owns the Brick) and IKEA. Combined, those companies account for nearly half the market share in the country. Compared to the bargain prices of those behemoths—not to mention their competitors, such as Wal-Mart, Canadian Tire and Amazon—it’s hard to imagine how many of us would be willing to both design and pay for custom-built furniture.

Yet that may be changing. According to market research from the Texas-based shipping company uShip, 25 per cent of people are willing to pay more for unique decor and 11 per cent regret buying mass-produced pieces from the typical producers—not to mention just about everyone is feeling pressure to up their decor game after scrolling on Instagram and Pinterest, or peeping into co-workers spaces on Zoom. Michael Prokopow, an associate professor at OCAD University, also notes that by making customization available to a broader number of customers, sites such as Naya could help bring down the price of bespoke. “The economies of scale can become such that if someone needs to fill a corner with something they can’t find at IKEA and they can find someone who can make that something for a just a little bit more money than IKEA, why wouldn’t they?” he says. “It might not result in brilliant design, but it will probably make customers happy.”

Naya might also be entering the market at the right time. “A number of macro factors are driving demand for furniture at all price points right now,” says Joel Alden, central Canada consumer lead at EY, who has spent 20 years consulting retail clients. “With the pandemic, there are work-from-home tax incentives, many businesses are helping employees set up home offices, and people want to be comfortable in their spaces. Plus, consumers are getting more comfortable buying furniture online.”

The number of Naya customers is private. In addition to a client base that includes regular homeowners (for example, one father in New York spent $500 to make his son a craft desk), other early adopters are surprising, including huge companies such as Google as well as several furniture makers like Steelcase, Herman Miller and Wayfair. “Most of our customers right now are enterprise clients,” says Rajan. “They have the ability to manufacture vast numbers of pieces on their own. What they are coming to us for is to make prototypes, small batches or to outfit individual offices.” That uptake gives Rajan confidence that Naya can expand beyond decor. “We started with furniture, which is neither too simple nor overly complex,” he says. “If we succeed with that, there’s no reason why we can’t focus on different industrial products or scale.”

TRENDSPOTTING

Learn why old-fashioned pastimes and non-electronic games are making a major comeback during the pandemic, how tech firms are out-boxing Big Pharma in the fight against COVID-19 and why “ghost kitchens” are more vital than ever right now.