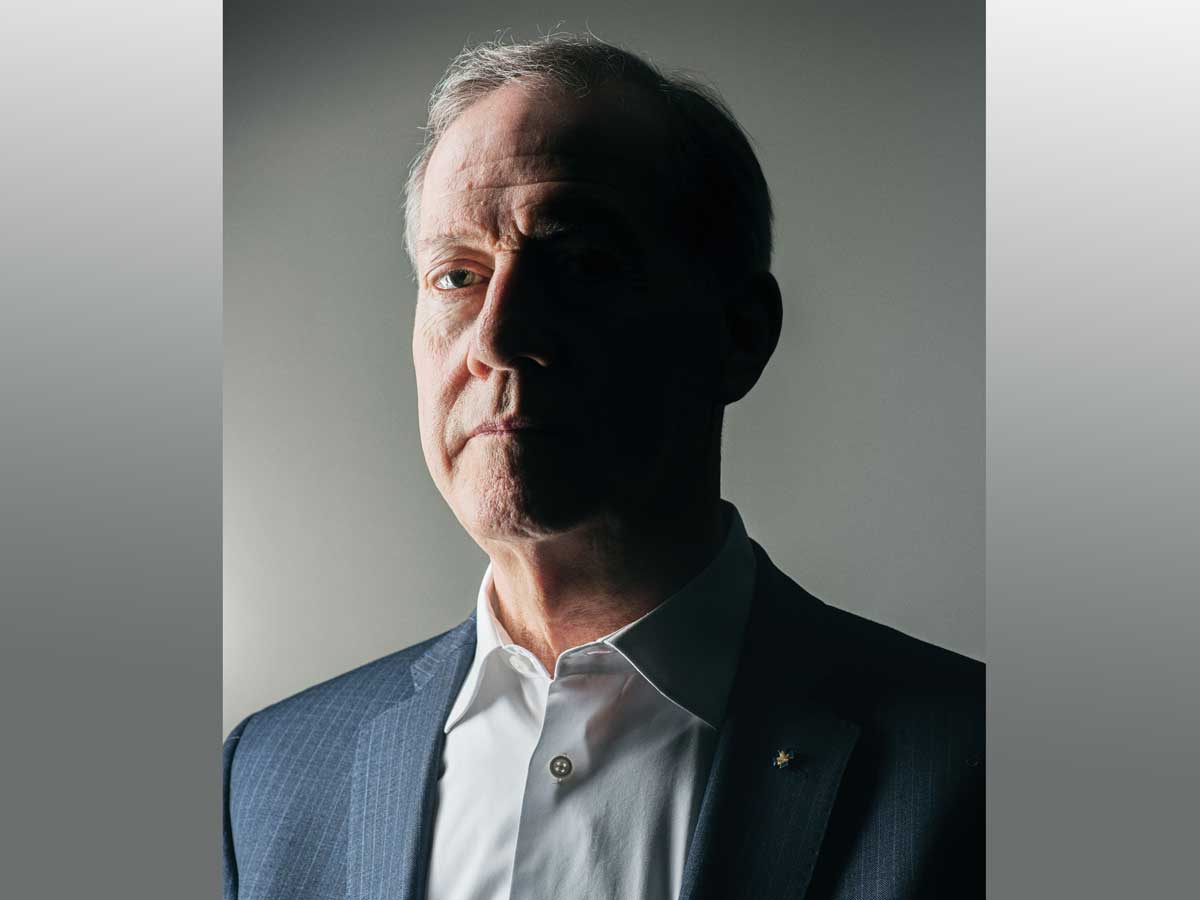

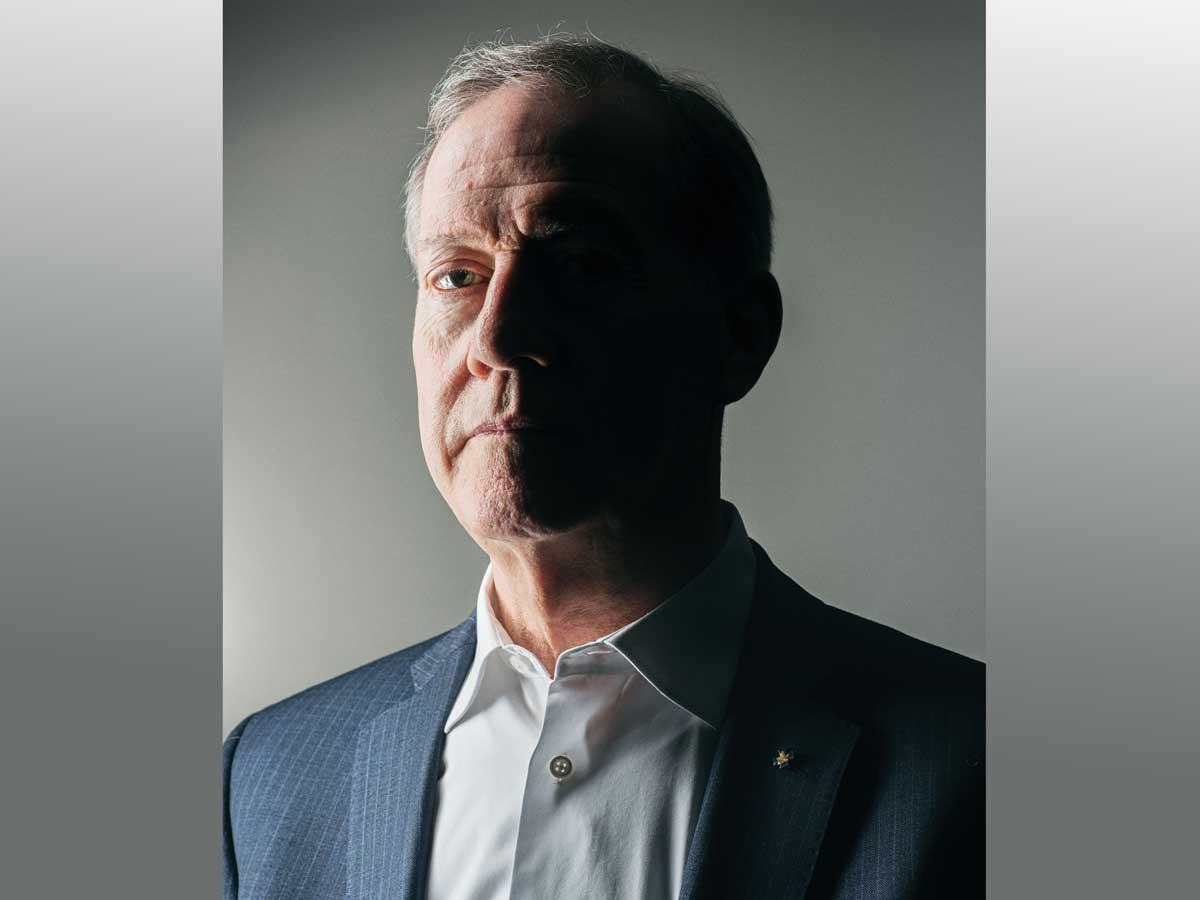

Peter German is on a mission

“Dirty Money,” along with a subsequent report that Peter German released in March 2019, sent shock waves through Canada’s political, legal, business and law-enforcement circles (Photograph by Troy Moth)

“Dirty Money,” along with a subsequent report that Peter German released in March 2019, sent shock waves through Canada’s political, legal, business and law-enforcement circles (Photograph by Troy Moth)

A man in a dark jacket approaches the cash cage at a B.C. casino, carrying a red cloth shopping bag. Flanked by security guards, he slides the bag across the counter, and a casino employee dumps out its contents: stacks of $20 bills bundled in elastic bands, just like in the mob movies. The cashier lines them up in even rows and begins to count. The sum, in excess of $250,000, will be exchanged for chips and later cashed out in the form of larger-denomination bills and cheques. This is how dirty money becomes clean.

Video footage of this transaction—just one of countless such exchanges that have taken place over the past decade—provided a visual punch to the release of “Dirty Money,” an explosive report on money laundering in B.C. casinos. At a June 2018 press conference in Vancouver, the report’s author, lawyer and former RCMP deputy commissioner Peter German, stood by as the security camera feed rolled. The source of the money, he told reporters, was the drug trade—mostly proceeds from opioid sales controlled by organized crime. “You’ll notice the elastic bands around the wads of twenties,” he said. “That is not how the banks issue cash.”

“Dirty Money,” along with a subsequent report that German released in March 2019, sent shock waves through Canada’s political, legal, business and law-enforcement circles. German’s findings drove home just how deeply money laundering has permeated not only B.C.’s gambling industry—an estimated $100 million in dirty money has passed through the province’s casinos—but also other industries where large sums of cash are still commonly accepted. German estimated that a staggering $5 billion was laundered in B.C. real estate in 2018 alone, which reportedly caused the average cost of a Metro Vancouver home to rise by five per cent. The auto industry is also infected: In one of the reports, German details how a money launderer walked into a car dealership with $200,000 in cash and purchased a luxury vehicle; when the bank later asked dealership staff about the provenance of the money, they said it was from a car sale. No further questions were asked.

German’s most alarming finding is that all this financial crime has gone largely unpunished. Even though, for instance, B.C. casinos log suspicious transactions, enforcement stemming from those logs has been practically nil. In a statement, former RCMP assistant commissioner Kevin Hackett called the report’s findings a “snapshot in time” and said that they didn’t reflect every money laundering case. He wrote that eight of the RCMP’s 40 “prioritized projects” in B.C. involve money laundering, and that the force is also assisting a number of national and international money laundering investigations.

Still of a B.C. casino cash cage, where roughly $250,000 in dirty money was converted into chips (Photography courtesy of the Government of British Columbia)

Still of a B.C. casino cash cage, where roughly $250,000 in dirty money was converted into chips (Photography courtesy of the Government of British Columbia)

Nonetheless, money laundering remains rampant because it is impossibly complex, costly to fight and receives little public attention, probably because the exchange of bills seems like a victimless crime. It isn’t, German insists. Laundering deprives governments of tax revenue and enables corruption, as it cleans the proceeds of bribery, embezzlement, illicit drug sales and other financial crimes. Dirty money has a steep human cost, too. “Thousands of families have lost sons or daughters due to opioids, fentanyl, heroin, cocaine,” says German. “That’s why this is important.”

In May 2019, with German’s reports in hand, the B.C. government announced it would launch the Cullen Commission, a public inquiry into the province’s money laundering problem that will have more legal authority than German did to compel witness testimony and gather evidence. The wide-ranging commission will analyze several B.C. sectors, including law and accounting, which are self-regulated at the provincial level. Currently, accountants and accounting firms have reporting obligations under federal anti-money laundering and terrorist financing legislation. The commission’s broad-ranging terms of reference indicate that it is to make recommendations that it considers “necessary and advisable” in respect to the regulation of the professional services sector, which includes law and accounting. Opening statements began in February, and the main hearings will begin in September.

But a provincial inquiry can only go so far, because money laundering isn’t restricted to any one province. Wherever there is organized crime, there is dirty money that needs to be cleaned. A follow-up report on money laundering in real estate led by Simon Fraser University professor Maureen Maloney estimates that $47 billion was laundered through Canada in 2018. In 2015, Canada’s money laundering problems were estimated to be the worst in Alberta, which topped the chart at $10.2 billion, followed by Ontario at an estimated $8.2 billion. German says no one knows the true total.

“All the things that make Canada a wonderful place to live also make it desirable for organized crime: large ports and airports, modern banking and communication, large ethnic diasporas, easy land access to the U.S.,” says German. “Plus, we have established organized crime networks, relatively mild criminal sanctions, a forgiving justice system and difficulty investigating and prosecuting financial crime.” Art Vertlieb, a B.C. lawyer who has known German for years, says it’s essential that governments across Canada tackle the problem. “Wherever you have corruption, it can erode the social, legal and economic fabric of the country,” he says. “It’s like a cancer.”

In the wake of “Dirty Money,” the 2019 federal budget allocated $200 million over five years to anti-money laundering measures, including a task force and extra RCMP funding. Still, German argues that more is needed. In the past, pressure from the international community has compelled the Canadian government to make necessary legislative changes and dedicate the proper resources to eradicate money laundering. “Unfortunately, that’s what it may take again,” he says. “I put it down to political and bureaucratic will. We have a pretty comfortable lifestyle and tend to turn a blind eye.” But thanks to German, money laundering is no longer a problem that Canadians can ignore.

“All the things that make Canada a wonderful place to live also make it desirable for organized crime”

Canada’s foremost money laundering expert stands with the ramrod-straight posture of a Mountie, but there’s no stereotypical cop stiffness in his speech. Instead, he has a warm, self-deprecating demeanour. At 68, he divides his time between practising law, consulting on financial crime and criminal justice, acting as president of the International Centre for Criminal Law Reform at the University of British Columbia, and spending time with his family—he and his wife, another retired Mountie, have two adult daughters. He wrote Proceeds of Crime and Money Laundering, Canada’s leading textbook on the topic, in 1998, and updates it six times a year.

German was born in Vancouver in 1952 and grew up with two goals: become an RCMP officer and become a lawyer. Most people would have jettisoned one dream for the other; German achieved both. As a young beat cop, he was stationed in tiny rough-and-tumble communities in Atlantic Canada. He took a break from police life to complete a law degree and work as a lawyer in Prince George, B.C., but he returned to the RCMP in 1986, resuming his ascent to deputy commissioner, the second-highest position in the force. Along the way, he earned five university degrees, including a PhD in law, most of them as an active Mountie. His friends and colleagues describe him as curious, ambitious and tireless. “He’s notorious for not sleeping,” says John Dickson, a fellow lawyer and former RCMP officer. “You’d get emails from Peter at all hours of the night. He’s one of those guys who will sleep four or five hours, if that. Otherwise, he’s working.”

Former colleagues say German’s even-handedness and superb investigative instincts have allowed him to stickhandle some of Canada’s most high-profile and politically sensitive inquiries with almost no allegations of bias. In the early 1990s, he led the investigation into “Bingogate,” a scam that funnelled the proceeds from charitable bingo games and lotteries into the B.C. NDP coffers; the ensuing scandal brought down the NDP government of the day. (The irony that German now works for another NDP government in B.C. is not lost on him. “I’m not a political animal,” he says.) Six years later, he was asked to assemble a new team to assume conduct of the Airbus investigation after the original case—examining allegations that senior Progressive Conservative staffers profited from kickbacks from the sale of Airbus jets to Air Canada—ended in disaster. A key player in the scandal, Karlheinz Schreiber, was later arrested, deported to Germany and charged with fraud, bribery and tax evasion.

B.C. Attorney General David Eby considered German’s reputation for impartiality a plus when selecting him to write “Dirty Money.” “If I brought someone in who had even a hint of being in the bag for the NDP, the findings wouldn’t be credible,” he says. German’s work is beyond reproach, says Ernie Malone, a retired RCMP chief superintendent and accountant who worked alongside German in Vancouver. “If there’s one word that stands out with Peter, it’s integrity.”

Peter German (left) and B.C. Attorney General David Eby released the first “Dirty Money” report in June 2018 at a press conference in Vancouver (Photograph by Canadian Press)

Peter German (left) and B.C. Attorney General David Eby released the first “Dirty Money” report in June 2018 at a press conference in Vancouver (Photograph by Canadian Press)

German’s “Dirty Money” report outlines just how complex modern money laundering schemes have become. The document describes in detail the “Vancouver model,” a term coined by John Langdale, a professor at Macquarie University in Australia. The model is meant to circumvent Chinese currency restrictions, which limit the amount of money that can be removed from China. The process begins when a Chinese resident transfers money, obtained either legally or illegally, to an underground banker in China. The resident then flies to Vancouver, where they meet the banker’s accomplice, who presents them with their cash in Canadian currency, predominantly $20 bills sourced from drug sales. Finally, the resident buys chips at a casino, gambles and cashes out, leaving with higher-denomination bills or a cheque. Everyone involved gets what they want: The resident removes money from China, Canadian criminals clean their cash and the underground bankers take a cut.

Stopping schemes like these is incredibly challenging and expensive, says German, partly because of the legal and accounting expertise needed to tackle them, but also due to their transnational nature. Adding to the difficulty are Canada’s “clunky” money laundering laws, which make it a challenge to meet the bar for a criminal prosecution, says CPA Jerome Malysh, a former RCMP sergeant and forensic accountant who assisted with the “Dirty Money” report. In the U.S., every industry is required to report cash receipts over $10,000. Canada, meanwhile, has a hodgepodge system of reporting requirements. Securities laws are provincially controlled and inconsistent. In most provinces, registered ownership—which can differ from beneficial ownership—is the focus, making it challenging to identify who owns what, be it real estate or corporations. (Following German’s reports last year, B.C. established the country’s first beneficial ownership registry.) “Casinos, banks and credit unions report,” says German. “But the auto sector, boats, auction houses, private mortgage companies, real estate appraisers—none of them report.” When one loophole closes, organized criminals move to another. For instance, B.C. has introduced new anti-money laundering legislation, but the number of suspicious cash investigations in Ontario doubled in 2018, according to Global News. German describes it as playing a game of whack-a-mole.

Still, all the reporting requirements in the world won’t help if there is no enforcement. The RCMP invested heavily in fighting commercial crime in the wake of the Enron scandal in the early 2000s, when German was the top officer in charge of financial crime. But in recent years, the force has shifted resources away from financial crime, possibly because money laundering cases are so difficult and costly, and so rarely produce convictions. A recent Toronto Star investigation showed that, between 2012 and 2017, 86 per cent of charges for laundering the proceeds of crime never made it to trial. Such charges are often resolved by guilty pleas to other, usually drug-related, charges. As a result, the RCMP have moved on to “easier and better things,” says Malysh. In December, the RCMP disbanded Ontario’s financial crimes unit to focus on national security, organized crime and drugs, the Toronto Star reported. “At the municipal level, a lot of police departments still have financial crime units,” says Malysh. “But they’re not doing money laundering.” For one, he says, money laundering prosecutions are a federal responsibility. Plus, “They can’t afford it.”

Yet German remains optimistic. His reports include a series of recommendations for fighting money laundering, including implementing expanded cash reporting requirements, devoting more resources to enforcement and prosecution, improving mandates for regulators such as FINTRAC, addressing beneficial ownership of corporations and trusts, and sharing more information between law enforcement, industry and regulators. B.C. has moved quickly to adopt some of German’s recommendations, such as mandatory money laundering courses for realtors. The full list of fixes may seem overwhelming, but German argues that they are not impossible. “Just look at the United States. They’ve already done it,” he says. “It just requires political will.”

CPAS FIGHTING MONEY LAUNDERING

Learn how accountants can help stop the flow of dirty money and aid companies in adapting to the new beneficial ownership rules. Also, understand why it’s important for Canada to take action immediately against money laundering.