News in brief: Cullen Commission’s final report released

The Cullen Commission’s 1,800-page report on money laundering in B.C. includes 13 pertaining to the accounting sector

The Cullen Commission’s 1,800-page report on money laundering in B.C. includes 13 pertaining to the accounting sector

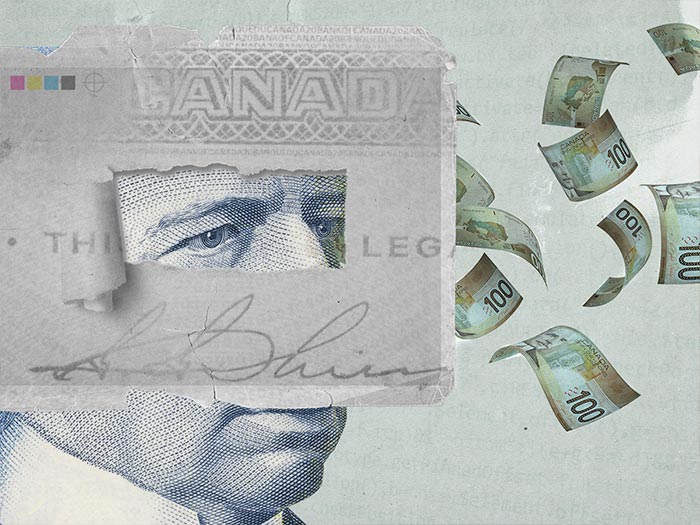

CULLEN COMMISSION’S FINAL REPORT INCLUDES RECOMMENDATIONS FOR ACCOUNTING SECTOR

On June 15, the Commission of Inquiry into Money Laundering in British Columbia released its final report with 101 recommendations, including 13 pertaining to the accounting sector.

Inquiry commissioner Justice Austin Cullen delivered the report, which is based on the testimony of nearly 200 witnesses over 130 days of hearings. Among its findings, the report states the federal anti-money laundering regime is not effective and the Commissioner recommends that the Province of B.C. should establish an independent AML Commissioner to provide oversight of the provincial response to money laundering.

Both CPA Canada and CPABC were involved in the work of the Cullen Commission, including providing testimony, written submissions and relevant documents. The Commissioner endorsed the work being done by the profession toward awareness of the need for a national whistleblower framework and urged its continuation. The Commissioner states that, in his view, the accounting profession faces risks and vulnerability and, where the federal regime is deemed to be insufficient in this regard, he recommends that CPABC do more in parallel with the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC).

Given the importance of the Commission’s final report, the profession will take the time necessary to study the findings and analyze its recommendations.

“Money laundering is a complex issue that has a detrimental impact on our economy and society and challenges the integrity of Canada’s financial system,” says FCPA Michele Wood Tweel, vice-president of regulatory affairs at CPA Canada. “Our profession recognizes the threats posed by money laundering and is committed to being part of the solution in the fight against it.”

NEW CANADIAN SUSTAINABILITY STANDARDS BOARD APPROVED

The Canadian Sustainability Standards Board (CSSB) has been mutually approved by the Accounting Standards Oversight Council (AcSOC) and Auditing and Assurance Standards Oversight Council (AASOC).

In keeping with the growth of sustainability reporting, the creation of the CSSB was recommended by the Independent Review Committee on Standard Setting in Canada (IRCSS). The new board is being created to ensure Canadian standards continue to be relevant and responsive.

The CSSB will work in lockstep with the International Sustainability Standards Board (ISSB) to ensure the Canadian perspective is part of international decision making.

“In light of the momentum in this space, the committee felt it important to fast-track our recommendation to establish the CSSB to the oversight councils now,” says Edward J. Waitzer, IRCSS chair.

An implementation committee is being established to support the significant work to create this new board.

The final recommendation report is expected to come this summer, with the goal of having a fully functional CSSB by April 2023.

CANADIAN ACSB CHAIR APPOINTED TO IASB

FCPA Linda Mezon-Hutter will be stepping down as the Canadian Accounting Standards Board (AcSB) chair to join the U.K.-based International Accounting Standards Board (IASB) as a member in September 2022.

Mezon-Hutter has been the AcSB chair since July 2013, where she has helped lead groundbreaking standards milestones, including Canada’s adoption of IFRS standards, as well as developed notable sections of the Handbook for not-for-profits, pension plans and private enterprises.

“My time as AcSB Chair brought me all around the world, enabling Canada to establish strong ties with other standard setters, learn from each other and confirm for me what a strong financial reporting environment we have in this country,” says Mezon-Hutter. “I bring this wealth of experience with me to the IASB, where I look forward to continue being a constructive voice in the development of globally accepted accounting standards.”

Throughout her career, Mezon-Hutter has held other high-profile positions, including chief accountant at RBC. She also has four years of experience in public accounting.

“The appointment of Linda to the IASB is a tremendous achievement for Canada,” says Lorraine Moore, chair, Accounting Standards Oversight Council (AcSOC). “Canada’s globally recognized reputation in standard setting has been strengthened by Linda's leadership on the AcSB and her commitment to establishing high-quality standards in Canada and globally.”

A search for an AcSB interim chair is now underway.

PRACTITIONERS PREPARE FOR NEW QUALITY MANAGEMENT STANDARDS

With the new quality standards taking effect in December 2022, CPA Canada is raising member awareness to help firms build their systems of quality management and strengthen the delivery of quality services.

Here is some recently issued guidance:

Practitioner’s Pulse webinar: Quality management, practical application considerations held on June 14 brought together practitioners from BDO Canada LLP and RSM Canada LLP for a live discussion on their personal experiences developing these systems and applying the requirements of the new quality management standards, CSQM 1, CSQM 2 and CAS 220. The webinar is now available on demand.

New standards introduce a robust and proactive approach to quality management, an article written by CPA Jacqui Kuypers, principal of the Audit and Assurance Standards Board, outlines the three quality management standards and calls out how firms can start implementing them.

Quality management conforming amendments is a practitioner’s alert that highlights the consequential changes that were made to other Canadian standards related to the quality management, the effective dates of the quality management standards and resources to help prepare for the implementation.

And Implementation tool for practitioners: New quality management standards is a guide for first-time adopters that answers your questions, from the possible impacts of CSQM 1 on your firm to factors to consider in evaluating your firm’s system of quality management.

More information and free quality management resources can be found online.

CANADA’S HOUSING TROUBLES REVEALED IN NEW SURVEY

CPA Canada’s latest research, The Housing Headache study, reveals breaking into the Canadian housing market is difficult.

Of those surveyed, 53 per cent owned a home and 45 per cent rented or leased. Half of the non-homeowners surveyed feel they will never buy a house, with 29 per cent saying they are somewhat likely to and just 21 per cent of respondents believing it’s very likely they will one day own a home.

The survey cited potential interest rate increases as the main barrier to home ownership, reported by 89 per cent of participants. The next biggest challenge is affording a down payment (84 per cent), followed closely behind by funds for necessary renovations (83 per cent) and housing availability in a desired area (83 per cent).

“Shifting your mindset and taking a hard look at expectations can be a good place to start when it comes to managing the housing headache,” says Doretta Thompson, CPA Canadas financial literacy leader. “Weigh your needs against wants and consider what you can afford based on your income and lifestyle.”

For more details on the survey, a background document is available online: cpacanada.ca/housingheadache.