B.C.’s Cullen Commission on money laundering to hear from accountants next month

The Cullen Commission’s main hearings began on October 26 and are expected to end in April 2021

The Cullen Commission’s main hearings began on October 26 and are expected to end in April 2021

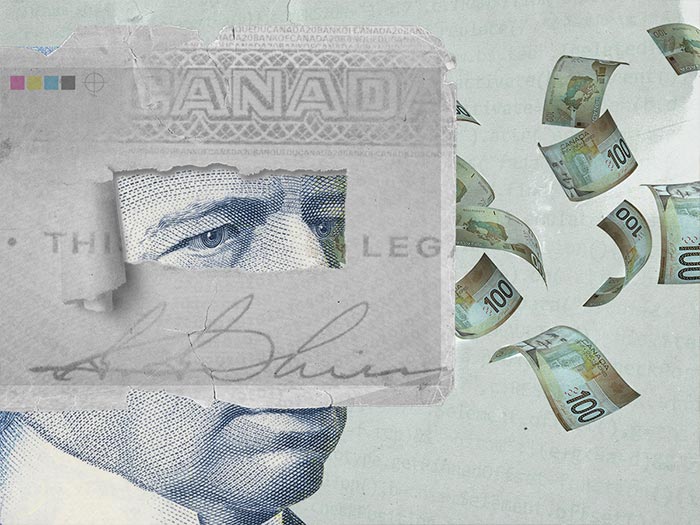

For years, money laundering has plagued the international economy, with some studies estimating the flow of dirty money at two to five per cent of global GDP.

And Canada is far from immune: one report commissioned by the government of British Columbia estimated that approximately $46.7 billion was laundered through the Canadian economy in 2018, with B.C. alone accounting for about $7.4 billion.

In May 2019, as part of its response to this pervasive and enduring problem, the province of B.C. launched the Commission of Inquiry into Money Laundering in British Columbia (known as the Cullen Commission).Two periods of public hearings were already held last spring, and the main hearings are currently underway; they began on October 26 and are expected to end in April 2021. In this current phase, the Commission is considering a variety of specific topics including professional services which encompass those provided by lawyers and accountants.

The Commission’s terms of reference are broad and include making findings of fact regarding money laundering in B.C. and formulating recommendations to address the conditions that have enabled money laundering to grow. This includes considering the role of regulatory agencies and individuals, as well as the scope and effectiveness of their regulatory systems regarding combatting money-laundering.

As Lori Mathison, FCPA, president and CEO of CPA BC, points out, “The Commission is making information available to the public about money laundering and relevant policy issues. Jurisdictions around the globe know that fighting money laundering is a continuous journey to protect financial systems and society. Educating the public is a critical step in that journey.”

Given that a public inquiry is by nature an investigative process, questions are asked of the sectors under review and this includes lawyers and accountants. The legal profession was the focus from November 16 to 20, and during that time, the Commission heard from organizations and bodies such as Canada’s Financial Intelligence Unit, FINTRAC, the Federation of Law Societies of Canada, the Law Society of British Columbia and academics from the U.K. who have studied money laundering as well as the role of professionals in anti-money laundering (AML) regimes. The topics were varied and included the regulation of lawyers, the involvement of lawyers in money laundering and comparisons of anti-money laundering regimes in other jurisdictions and the requirements in those regimes that are applicable to lawyers.

“In reviewing the professions, the Commission seeks to understand the roles, regulatory requirements and contributions of the professions toward anti-money laundering. Internationally, anti-money-laundering regimes vary as do the scopes of practice for professionals. Ultimately, to protect financial systems and society at home and abroad, Canada’s AML regime must address and respond to its unique current and evolving risks,” says Michele Wood-Tweel, FCPA, vice-president of regulatory affairs at CPA Canada.

A STRONG STAND

As we know, CPAs have a legislated role in the fight against money laundering, and CPA Canada has been actively contributing to the federal government’s efforts to strengthen the AML regime. Specifically, CPA Canada has been represented on the Advisory Committee on Money Laundering and Terrorist Financing, co-chaired by Finance Canada, and two of the committee’s working groups that are considering legislation and regulations and guidance and policy interpretations issued by FINTRAC.

Internationally, CPA Canada has participated in AML policy discussions, including those held in the private sector forum of the Financial Action Task Force, which is the global standard-setter for AML, as well as B20 task forces. Recently, it contributed to policy discussions in Canada and internationally regarding the role of beneficial ownership transparency—widely considered a key ingredient for strengthening AML regimes.

At the Commission hearing focusing on the accounting profession, which is expected to take place in early January, the profession will be represented, with both CPA Canada and CPABC having participant status in the formal Commission process.

The Commission submitted an interim report to the B.C. government on November 15, 2020 and its final report is due by May 15, 2021.

As a reporting sector under Canada’s anti-money laundering regime, the CPA profession’s participation at the Commission is important. It presents an opportunity to contribute to the public interest as the Commission carries out its mandate for B.C.

FOCUS ON MONEY LAUNDERING

Looking to learn more about money laundering and how CPA Canada is working to help strengthen the AML regime? See How accountants can help fight money laundering, Anti-money laundering policy, Feds boost anti-money laundering investment as Canada fights ‘dirty money’ and Money laundering is a national crisis. What now?