CPA practical experience: Competency requirements

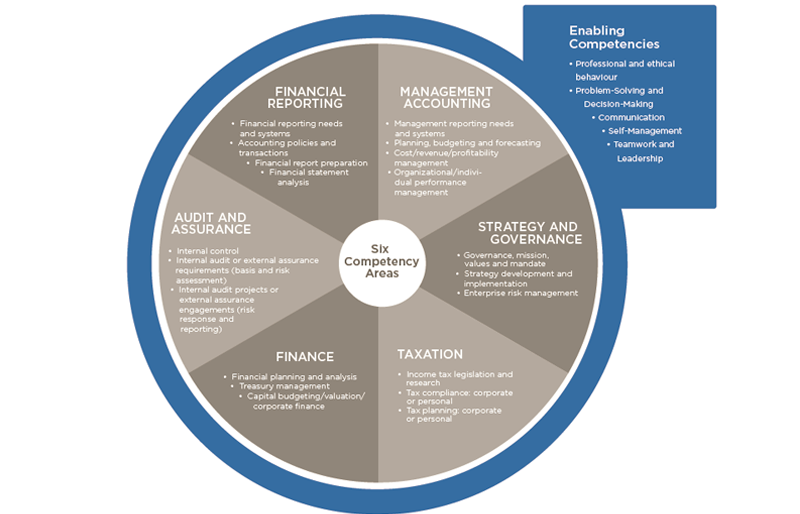

Future CPAs must develop both technical and enabling competencies through their qualifying practical experience term.

Technical competencies fall into six areas:

- financial reporting

- management accounting

- audit and assurance

- strategy and governance

- finance

- taxation

Within each technical competency area, there are three or four competency sub-areas. Future CPAs must achieve a range of competency sub-areas to complete the core, depth and breadth, and progression requirements. Competency sub-areas are developed over time as future CPAs demonstrate competency statements that make up each area.

Understanding progression

The progression concept is embedded in required competencies. At the start of the practical experience term, the future CPA’s work will be largely confined to retrieving and comprehending information. As further experience is gained, the future CPA develops analytical ability and, by the end of the practical term, can make effective decisions and solve problems as well as take on increasingly complex and less routine work.

Proficiency levels

Future CPAs are not expected to demonstrate achievement of all technical competencies, but must achieve a selection at both Level 1 and Level 2 as defined by core, depth and breadth requirements.

- Level 0 is purely administrative or clerical experience.

- Level 1 is professional experience, but it is lower than expected for a newly certified CPA. This level can include tasks, which are routine in nature, of a low level of complexity. Level 1 can also include tasks that can be executed with a lower level of autonomy.

- Level 2 is experience expected of a newly certified CPA. Completed tasks can be both complex and undertaken with autonomy. Highly complex tasks undertaken with a moderate level of autonomy may also count as Level 2 experience.

Enabling competencies

Enabling competencies reflect the personal attributes of a CPA. These are the essential skills that are pervasive to a CPA’s work environment and allow a CPA to function as a competent professional in an increasingly complex and demanding environment:

- professional and ethical behaviour

- problem solving and decision making

- communication, both oral and written

- self-management

- teamwork and leadership

By the end of the term of practical experience, future CPAs are required to develop a Level 2 proficiency in all five enabling competencies.

Learn more about technical and enabling competencies in CPA Practical Experience Requirements: The CPA Practical Experience Competencies.