‘Inflation could last through the first quarter of 2022’

Short-term absenteeism due to the Omicron variant is putting a lot of pressure on the workforce, which will impact our economy (Getty Images/Luis Alvarez)

Short-term absenteeism due to the Omicron variant is putting a lot of pressure on the workforce, which will impact our economy (Getty Images/Luis Alvarez)

The arrival of the Omicron variant has changed a number of things in the Canadian economic landscape. We asked David-Alexandre Brassard, chief economist at CPA Canada, to highlight the main issues the country will be up against in the months ahead.

CPA CANADA: What kind of economic recovery can we expect in 2022?

David-Alexandre Brassard (DAB): The impact of the Omicron variant, which nobody saw coming, is likely to be felt throughout the first quarter. While sectors such as real estate services (+3.2%), financial services (+6.5%) and professional services (+4.5%) are doing well compared to pre-pandemic levels, others, such as arts and entertainment (-27%) and accommodation and food services (-13%), are already hit hard.

In terms of GDP, we can expect a pause or even a slight decline, in the first quarter. The pre-pandemic level of economic activity may not be recovered until mid-year.

- Resources: Providing business guidance for COVID-19 issues

- Resources: Business continuity in a crisis: COVID-19 challenges

Furthermore, support programs (both stimulus hiring and programs specific to certain sectors or to businesses and workers under health restrictions) are more restrictive in terms of eligibility and less generous than the programs in place before October 2021.

CPA CANADA: 2021 was a challenging year for supply chains. Will it be the same in 2022?

DAB: Because many Canadians were unable to purchase certain services over the past year (such as restaurant dining and travel), they shifted to purchasing goods, which put additional pressure on the global supply chain. Consumption is traditionally lower in January and February. Will this decline last? It’s hard to say.

One thing is for sure, Omicron will put a lot of people out of commission, including in the freight sector. The reduction in the number of isolation days in several provinces and countries will not solve everything. Also, the western provinces may be impacted by the weather events that occurred in late 2021. In short, I expect another difficult winter, and even spring, in this regard.

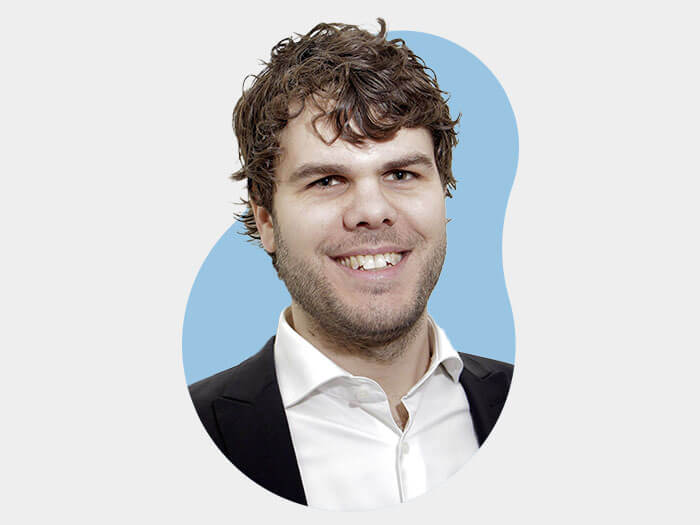

David-Alexandre Brassard, CPA Canada's chief economist

David-Alexandre Brassard, CPA Canada's chief economist

CPA CANADA: How is the labour market doing in general?

DAB: Short-term absenteeism caused by COVID-19 is putting a lot of pressure on the workforce. Especially since many employees have left sectors such as hospitality and food services to move into jobs where the pay is not as directly related to customer volume, such as professional services (such as accounting, consulting, IT, etc.) or even retail. This is particularly true in Quebec, Ontario and British Columbia, which are populous provinces where workers have more opportunities to change careers. This trend could continue as long as customer traffic remains low.

In terms of labour shortages (job vacancies have almost doubled since the start of the pandemic), employers should also focus on finding ways to retain experienced workers (55 and over), who are particularly important in a knowledge economy.

- Q&A: BDC’s chief economist Pierre Cleroux on labour shortages

- Feature: 5 ways to inspire, engage and retail staff

While it will not solve all labour problems, immigration will also be an important issue this year. Never in the past 35 years has Canada had such low net migration than in 2020 (four times lower than in 2018 and 2019). Simultaneously, many non-permanent residents returned to their country of origin. This left a big deficit. Immigration rebounded strongly in 2021 with Canada reaching its immigration target. Governments still need to make sure they address processing delays to reduce friction for newcomers and ensure we keep as many as we can.

CPA CANADA: Inflation was a big issue in 2021. Will it slow down?

DAB: Part of the inflation issue is due to the imbalance between demand and supply, so it could last through the first quarter of 2022. That said, people will have less money to spend in the coming months, partly because government assistance programs are less generous, so the situation could stabilize.

- Pivot Magazine: The inflation problem: How did we get here?

- Feature: Don’t pay the same for less: how to stay on top of shrinkflation

Interest rates are not expected to rise until mid-year or until economic activity is back to pre-pandemic levels. As long as it doesn’t change in the U.S. (where inflation is even higher), it’s unlikely to change here.

However, the rise in home prices is something to watch, as the affordability problem it has created in major centres is spreading across Canada. This is partly because of telework, which has given many workers more freedom in where they set up house. While Alberta is still seeing more reasonable price increases (because more housing is available there), Nova Scotia and New Brunswick are experiencing price growth comparable to provinces with larger metropolitan areas.

CPA CANADA: What can you tell us about government spending?

DAB: The federal government’s debt has risen from 30 per cent to almost 50 per cent of GDP. According to the 2021 Economic and Fiscal Update, Canada will have accumulated approximately $500 billion in additional debt by April 2022 since the pandemic began. That is a huge number. While we often hear that our overall debt ratio is good at the federal level, CPA Canada advocates a robust fiscal target where debt is no longer tied solely to our GDP. This would ensure that debt does not systematically increase when GDP grows.

- Public policy: The case for a fiscal anchor framework

- Feature: Fiscal update includes pandemic and flooding support

We should also question the level of governance surrounding government spending. The government did not release a budget in 2020, leaving a one-year gap without a budget, during which time it committed to almost $300 billion in additional spending. While the COVID-19 support plans will be reviewed after the fact by the Auditor General of Canada, it is concerning that the government has been able to spend so much without anyone having a say in the matter.