Making sense of data value chains

This article is part of our Mastering Data series, which examines the digitization underway in Canada’s economy, why it’s important, the data governance issues it creates, and how to address them. It also looks at the role you can play as a CPA in guiding your organization through the transition.

READ THIS ARTICLE TO LEARN:

- what is a data value chain

- why data value chains are important

- how data value chains work

- stages of a data value chain

- the role of CPAs in data value chains

What is a data value chain?

The term “data value chain” describes the process of turning raw data into something of value. Ultimately, organizations use data value chains to uncover vast volumes of information spread across their operations and make it available and useful to the areas of the organization that require this intelligence.

The data value chain is similar to other value chains, such as those in manufacturing, in that it breaks down the process into various subsystems, each involving inputs and outputs. How these systems and inputs and outputs are managed affects the quality, cost and, ultimately, the profit of the final product in any value chain. However, one way that data value chains differ from other value chains is that the final product is often actionable insights rather than a tangible product or service.

Why data chains are important

The ongoing digitization of Canada’s economy is creating a tsunami of raw information. Data has become a kind of medium of exchange that flows through our economy. And as with any currency, data only has worth when there are principles about how it is valued, measured and traded.

Integrity across the data value chain is critical. This presents an opportunity for CPAs, who are well positioned for the critical role of ensuring integrity by providing oversight and governance of data value chains.

How data value chains work

In understanding data value chains, it’s helpful to consider the analogy of a more familiar value chain: oil and gas.

Oil and gas value chains:

- begin with exploration activity and test drilling and then extend across multiple sub-sectors: refineries, pipelines, distribution and so on

- include different sorts of professionals who work at each stage: geologists, process engineers, high-skill pipe fitters and marketers, to name a few

- require high-level oversight by professionals, such as CPAs, who can measure the value of the resource, integrate sub-systems and ensure regulatory compliance.

A similar structure is necessary for data value chains, which depend on the flow of digital information rather than the flow of oil.

Data value chains:

- engage experts like data brokers, software engineers, data analysts and programmers

- collect data, exchange it, analyze it and provide solutions as to how to use it, such as feeding it into an artificial intelligence (AI) application

- require high-level oversight by professionals, such as CPAs, who can measure the value of the data, integrate sub-systems and ensure regulatory compliance.

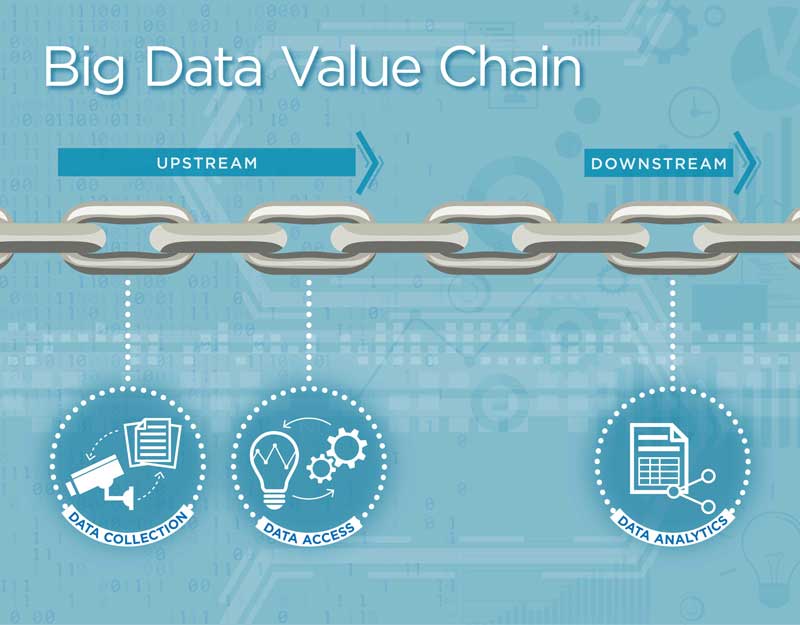

Stages of a data value chain

1. Collection and grading

Activities related to data collection and grading can take place anywhere in an organization. Records, web clicks, purchase orders, financial transactions, inventories, logistics and data collected by Internet of Things (IoT) devices are routinely collected through daily operations and activities.

For data scientists and AI developers to take advantage of any dataset, they need to understand its features, characteristics and limitations to determine if it is fit for purpose. Policies and procedures are needed to allow for data collection and grading to take place. As a profession that is unique in its involvement in all areas of an organization, there are many parts of this where accountants could have a role to play.

2. Access, sharing and retention

This segment of the data value chain is needed to make data accessible and usable.

It includes:

- the interface or platform that connects datasets with end users such as data scientists

- processes and protocols for how data will be accessed and stored

- decisions on the importance of data sharing with third parties.

3. Analytics and solutions

As more data is made available and accessible, it is expected that a growing number of AI consulting firms providing specialized insights to individual economic sectors or functions will enter the marketplace.

AI and data analytics consulting firms will be positioned to:

- use datasets from multiple sources to create new algorithms

- teach artificial intelligence algorithms and generate insights to clients

- embed algorithms in existing functions or processes

- use ongoing access to streaming data to offer new possibilities for machine learning and automated decision systems to operate

The role of CPAs in data value chains

- establishing an overarching framework—similar to the performance management systems or accounting and auditing standards used today—that allows organizations to take advantage of the value chain

- interaction by a range of emerging disciplines and professions that are linked to the effective flow of information both inside and between organizations

- oversight by professionals with the skills to address the risks and uncertainties associated with data sharing between divisions or branches in the same organization, and between arms-length organizations

The foundational elements of training for the CPA designation includes data interpretation for strategic decision making and a deep business understanding. These skills put professional accountants in a strong position to provide necessary oversight to the creation and management of data value chains.

While data value chains are a vital component of Canada’s economic future, today’s ground-level reality is that the vast majority of data analysis still occurs within single organizations. By establishing credible frameworks for mastering data within single organizations, CPAs will also establish the foundation for digital collaboration between organizations.

Data value chains must be properly segmented so that the right professionals manage the right components: cleaning up raw data, putting it in standardized formats, then aggregating, de-identifying, pooling, and mining it for insights. The CPA profession is trusted to build frameworks that ensure financial information is consistent, comparable, and reliable. Financial information is simply one form of data. CPAs’ expertise in ensuring the integrity of financial data provides the profession with foundational skills that can be applied to broader types of data.

MASTERING DATA SERIES

More information is available on the critical role CPAs can play in mastering data, including the following articles:

- Canada’s digital economy and the CPA

- Corporate data policy and its elements

- Creating a digitization strategy

- What is your data worth?