Fraud and going concern: What's your role?

With the impact of the global pandemic top of mind for many organizations these days, it is not surprising that the topics of going concern and fraud have been making headlines. Even before COVID-19 became a household term, however, questions were being raised as to what the auditor’s role is as it relates to fraud and going concern in a financial statement audit.

These questions have been increasing in recent years alongside several international headlines about corporate frauds and scandals. The most recent one in the news was the misappropriation of billions of dollars of assets at Wirecard.

The International Auditing and Assurance Standards Board (IAASB), in an effort to play its part in understanding these public interest issues, recently issued a discussion paper, Fraud and Going Concern in an Audit of Financial Statements. The discussion paper puts particular focus on fraud and going concern, but in doing so brings to the forefront a more pervasive issue, the “expectation gap.”

The Canadian Auditing and Assurance Standards Board (AASB) is examining this topic and has undertaken several stakeholder consultations since mid-September in preparing its response to the IAASB discussion paper. Keep reading to hear my take on what we've learned from our outreach.

The core of the issue: The expectation gap

For many, discussion of the expectation gap is not new. CPA Canada featured a story on it back in the first quarter of 2019. In that publication, the expectation gap was referred to as “the profession’s existential problem.”

The expectation gap has often been defined as the difference between what users of financial information think an auditor does and what they actually do. It has been a topic of conversation for decades. Everyone I spoke to during our consultations understood and acknowledged the expectation gap, but many struggled when I tried to get them to pinpoint a clear action on how we could narrow it.

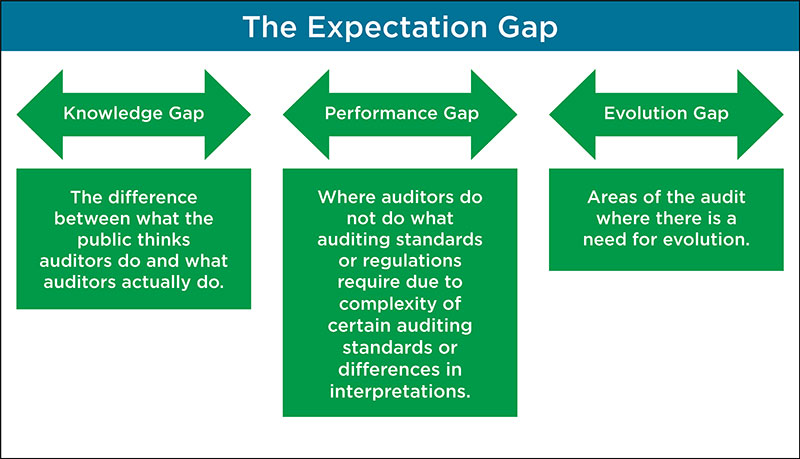

As the IAASB strives to make meaningful progress to address the expectation gap, they have broken it down into three components:

Does focusing on the components of the expectation gap help narrow the gap?

Our stakeholders had a lot to say about the expectation gap and accepted the idea of the different components. While many could quickly point to one component being a main factor, seldom did they suggest that any one component could be ignored. It also became evident to me when talking to financial statement users that the knowledge gap itself really underpins each of the other components. For example, if you are not clear on what an auditor’s role is today, it can be challenging to conclude on what their future role should be.

So, we know it exists, but what can we do about it? I heard clear agreement that everyone in the financial reporting ecosystem has a role to play. Most stakeholders emphasized management’s foundational role within an organization as it relates to both fraud and going concern. So, if, for example, management disclosed their internal controls in place to prevent and detect fraud, this could help the public better understand management’s responsibilities and contribute to narrowing the knowledge gap. Therefore, many believe that a collective and collaborative effort by all parties could drive positive change to the gap.

In the discussion paper, the IAASB acknowledges that they cannot meaningfully change the expectation gap by themselves, so they asked stakeholders for input on what actions they, as well as others, could take. I am curious to see what comes of this work and who else steps up to the plate to support the IAASB in their efforts.

Fraud: How can the auditor's role evolve?

In looking at how the auditor’s role might evolve, the IAASB identified a number of enhancements that they are considering, which included:

- increasing the involvement of forensic specialists in financial statement audits

- requiring auditors to adopt a "suspicious mindset" when planning and performing the audit

- exploring introducing additional engagement quality control review procedures

In the IAASB’s consultations, the topic of forensic specialists and the idea of auditors having a “suspicious mindset” dominated the discussions.

The increased use of forensic specialists received conditional support. Generally, we heard that mandating widespread use was of little value, with the cost of regularly involving these specialists far outweighing the benefits. Scalability was also raised in this area as many highlighted the challenges that may be faced in sourcing these experts should they be more widely used. However, there was support for targeted and purposeful involvement of forensic specialists based on the auditor’s professional judgment. For example, emphasis was put on the importance of a strong up-front fraud risk analysis by the auditor, which then could be used to determine when, where and how a forensic specialist should be engaged.

Without a clear definition of “suspicious mindset” in front of us, it was hard for Canadian stakeholders to have a productive conversation on how such a mindset might benefit the audit. Given the diversity of Canadian views, I imagine this will be an even more challenging debate on an international scale!

Regardless of how people defined it, many raised significant concerns as to whether the audit would be able to be completed given the perceived need for a greater burden of proof. The potentially negative impact on the auditor-client relationship was also mentioned. While this relationship was a focus for practitioners, an audit committee member I spoke to also emphasized the importance of a cooperative auditor-client relationship to ensure that there is open and honest communication.

Generally, we heard there is opportunity for the role of the auditor to evolve, but it is still early stages and more exploration into the proposals is needed.

Going concern: Who goes first?

The auditor’s role and the expectation gap as it relates to going concern is acknowledged to be a bit different than fraud. In the case of fraud, obtaining reasonable assurance about whether the financial statements, as a whole, are free from material misstatement, whether due to fraud or error, is stated right in the objective of the audit. However, as it relates to going concern, the auditor’s role is closely tied to management’s assessment of going concern. The auditor is required to obtain sufficient appropriate audit evidence regarding:

- the appropriateness of management's assessment

- whether a material uncertainty exists about the entity's ability to continue as a going concern

So, does the auditor’s role related to going concern need to evolve independent of management’s role? Can it even? Or does management need to change first? There was consensus that any evolution of the auditor’s role was largely contingent on the actions of management and enhancements to the accounting requirements and disclosures. Even so, our stakeholders gave some direction on where they thought efforts should be focused.

The need for clarification of the concept of “material uncertainty relating to going concern” was commonly raised. Several audit committee members told me that the term “going concern” is confusing and not well understood outside of those within the accounting profession. Along similar lines, our stakeholders indicated that there is an inconsistent interpretation as to what is a “material uncertainty relating to going concern.” Addressing these areas is thought to be a worthwhile effort.

However, for the IAASB to make meaningful progress, the International Accounting Standards Board (IASB) will need to be engaged. This goes back to my earlier point on the need for everyone in the financial reporting ecosystem to contribute to moving forward.

What's next?

It is clear to me that to make a meaningful impact in narrowing the expectation gap and respond to calls for the role of all parties in the financial reporting ecosystem to evolve as it relates to fraud and going concern, neither the IAASB, nor any other party for that matter, can do it alone. I am anxious to see how closely the comments and suggestions in the responses to the discussion paper align on the actions each party in the financial reporting ecosystem needs to take to progress these initiatives.

Keep the conversation going

What was your reaction to the proposals raised in the discussion paper? Do you share the same views as our stakeholders? Post a comment below or email me directly. I look forward to hearing your views.

Conversations about Audit Quality is designed to create an exchange of ideas on global audit quality developments and issues and their impact in Canada.

Disclaimer

The views and opinions expressed in this article are those of the author and do not necessarily reflect that of CPA Canada.